Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section has effect if:

(a) an * NZ franking company:

(i) makes a * franked distribution; and

(ii) pays a supplementary dividend (as defined in section OB1 of the Income Tax Act 1994 of New Zealand) in connection with the franked distribution; and

(b) the franked distribution and the supplementary dividend * flow indirectly to an entity (the recipient ) in an income year because the recipient is a partner in a partnership or a beneficiary or trustee of a trust; and

(c) the recipient is entitled under section 207 - 45 to a * tax offset in connection with the * distribution; and

(d) the recipient is entitled to a tax offset under Division 770 for the income year because of the distribution.

Recipient that is a partner or beneficiary

(2) If the * franked distribution * flows indirectly to the recipient under subsection 207 - 50(2) or (3), then:

(a) the recipient can deduct an amount for the income year that is equal to so much of its share of the supplementary dividend as does not exceed:

(i) if the distribution flows indirectly to the recipient under subsection 207 - 50(2)--the recipient's individual interest in relation to the distribution that is mentioned in that subsection; or

(ii) if the distribution flows indirectly to the recipient under subsection 207 - 50(3)--the recipient's share amount in relation to the distribution that is mentioned in that subsection; and

(b) the recipient's * tax offset under section 207 - 45 is reduced by so much of the deduction under paragraph (a) as does not exceed its * share of the * franking credit on the distribution.

Recipient that is a trustee

(3) If the * franked distribution * flows indirectly to the recipient under subsection 207 - 50(4), then:

(a) the share amount mentioned in that subsection in relation to the distribution is reduced by so much of the recipient's share of the supplementary dividend as does not exceed that share amount; and

(b) the recipient's * tax offset under section 207 - 45 is reduced by so much of the reduction under paragraph (a) as does not exceed its * share of the * franking credit on the distribution.

What happens if certain provisions apply

(4) Subsection (2) or (3) (as appropriate) does not apply to the recipient in relation to the * franked distribution if one or more of the following provisions also apply to the recipient in relation to the distribution:

(a) subsection 207 - 95(1);

(b) subsection 207 - 95(5);

(c) subsection 207 - 150(1);

(d) subsection 207 - 150(5).

(5) If subsection 207 - 90(5) or 207 - 150(5) would also apply to the recipient in relation to the * franked distribution, apply that subsection on the basis that:

(a) the amount of the recipient's * share of the * franking credit on the distribution;

had been reduced by:

(b) so much of the recipient's share of the supplementary dividend as does not exceed the amount of that share of the franking credit.

When does a supplementary dividend flow to an entity?

(6) A supplementary dividend flows indirectly to an entity if it would have * flowed indirectly to the entity under subsection 207 - 50(2), (3) or (4), if:

(a) the dividend had been a * franked distribution; and

(b) a reference in that subsection to the entity's * share of the franked distribution had been a reference to the entity's share of the supplementary dividend.

Share of supplementary dividend

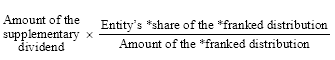

(7) The entity's share of the supplementary dividend is worked out as follows:

(8) Nothing in this section has the effect of including in the entity's assessable income its share of the supplementary dividend.

Relationship with Subdivisions 207 - B, 207 - D, 207 - E and 207 - F

(9) Subdivisions 207 - B, 207 - D, 207 - E and 207 - F have effect subject to this section.