Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The amount of the * tax offset under section 61 - 30 in relation to the other individual for the year is reduced by the amount worked out under subsection (2) of this section if:

(a) your entitlement to the tax offset is based on the other individual being your spouse during the year; and

(b) during a period (the shared care period ) comprising the whole or part of the year:

(i) you, or your * spouse while being your partner (within the meaning of the A New Tax System (Family Assistance) Act 1999 ), was eligible for family tax benefit at the Part B rate within the meaning of that Act; and

(ii) clause 31 of Schedule 1 to that Act applied in respect of that Part B rate because you, or your spouse, had a shared care percentage for an FTB child (within the meaning of that Act).

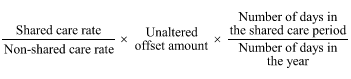

(2) The reduction is worked out as follows:

where:

"non-shared care rate" is the rate that would be the standard rate in relation to you or your * spouse under clause 30 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 if:

(a) clause 31 of that Schedule did not apply; and

(b) the FTB child in relation to whom the standard rate was determined under clause 31 of that Schedule was the only FTB child of you or your spouse, as the case requires.

"shared care rate" is the standard rate in relation to you or your * spouse worked out under clause 31 of Schedule 1 to the A New Tax System (Family Assistance) Act 1999 .

"unaltered offset amount" is what would, but for this section, be the amount of your * tax offset in relation to the other individual under section 61 - 10 for the year.