Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendments relating to the scope and administration of the Act

2 Subsection 3(1)

Insert:

"AWOTE" means full - time adult average weekly ordinary time earnings for all persons in Australia .

3 Subsection 3(1) (paragraph (ea) of the definition of eligible employee )

Repeal the paragraph, substitute:

(ea) a person to whom section 14A of this Act as previously in force applied immediately before that section was repealed;

4 Subsection 3(1) (after paragraph (eb) of the definition of eligible employee )

Insert:

(ec) a person included in a class of persons declared by the Minister to be eligible employees for the purposes of this Act;

5 Subsection 3(1) (definition of eligible employee )

Omit ", other than paragraph (ea),".

6 Subsection 3(1) (paragraph (j) of the definition of eligible employee )

Repeal the paragraph, substitute:

(i) a person who, immediately before the commencement of this paragraph, was included in a class of persons that, under the regulations in force at that time, were not eligible employees for the purposes of this Act; or

(j) a person included in a class of persons declared by the Minister not to be eligible employees for the purposes of this Act; or

7 Subsection 3(1) (definition of preservation fund )

Repeal the definition.

9 Subsections 3(1A) and (1B)

Repeal the subsections, substitute:

(1AA) The regulations may make provision for modifying this Act, or a provision of this Act specified in the regulations, in the application of this Act or that provision to and in relation to a person to whom paragraph (ec) of the definition of eligible employee applies or has applied or to and in relation to a prescribed class of persons to whom that paragraph applies or has applied.

(1A) A declaration made for the purposes of paragraph (ec) of the definition of eligible employee in subsection (1) may be expressed to have taken effect from and including a day specified in the declaration, being a day earlier than the day on which the declaration is signed but, subject to subsection (1B), not earlier than 12 months before the day on which the declaration is signed.

Note: The day of effect may be a day earlier than the day on which paragraph (ec) commenced (see subsection (1BC)).

(1B) If, before a declaration is made for the purposes of paragraph (ec) of the definition of eligible employee in subsection (1), contributions were accepted from, or in respect of, a person to whom the declaration applies, the declaration may be expressed to have taken effect from and including the earliest day on which contributions were so accepted.

Note: The day of effect may be a day earlier than the day on which paragraph (ec) commenced (see subsection (1BC)).

(1BA) A declaration made for the purposes of paragraph (j) of the definition of eligible employee in subsection (1) may be expressed to have taken effect from and including a day specified in the declaration, being a day earlier than the day on which the declaration is signed but not earlier than 1 July 2003, if, and only if, there is no person to whom the declaration applies:

(a) who was treated as an eligible employee on or after the specified day; or

(b) from, or in respect of, whom contributions were accepted on or after the specified day.

(1BB) A declaration that is expressed, in accordance with subsection (1A), (1B) or (1BA), to have taken effect from and including a day earlier than the day on which the declaration was signed, is taken to have had effect accordingly.

(1BC) To remove any doubt, a declaration made for the purposes of paragraph (ec) of the definition of eligible employee in subsection (1) may be expressed, to the extent permitted under subsection (1A) or (1B), to have taken effect from and including a day (the effective day ) earlier than the day on which that paragraph commenced. If a declaration is so expressed, it is taken to have had, before the day on which that paragraph commenced, the effect that the declaration would have had if that paragraph had been in force from and including the effective day.

(1BD) A declaration made for the purposes of paragraph (ec) or (j) of the definition of eligible employee in subsection (1) is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901 .

11 Section 3B

Repeal the section.

16 Subsection 5(2)

Omit "subsections (3), (3A), (3B) and (3C)", substitute "subsections (3) to (3E)".

17 After subsection 5(3)

Insert:

(3AA) Despite subsections (1), (2) and (3), an eligible employee and his or her designated employer may agree that a particular annual rate is to be the employee's annual rate of salary for the purposes of the application of this Act on a particular day and, if such an agreement is made, the agreed rate is taken to be the employee's annual rate of salary on that day.

18 Subsections 5(3A), (3B) and (3C)

Repeal the subsections, substitute:

(3A) If, at the time (the later time ) immediately before a person ceased or last ceased to be an eligible employee, the person was entitled to partial invalidity pension under section 77 or 78, the annual rate of salary payable to the person at the later time is to be worked out, for the purposes of this Act other than sections 77 and 78, under subsections (3B) to (3E).

(3B) If the person's entitlement arose under section 77, the annual rate of salary payable to the person at the later time is taken to be the amount per annum that would have been the person's final annual rate of salary at the time (the earlier time ) that was the occasion on which the person ceased or last ceased to be an eligible employee before the person's entitlement arose.

(3C) If the person's entitlement arose under section 78, the annual rate of salary payable to the person at the later time is taken to be the amount per annum that would, if the person had ceased to be an eligible employee on the day immediately before the day on which the person's entitlement arose, have been the person's final annual rate of salary at the time (the earlier time ) that would have been the occasion of the person's so ceasing to be an eligible employee.

(3D) However, if:

(a) the Australian Statistician has published, at or before the later time, an estimate or successive estimates of the change or changes (expressed as a percentage or percentages) in AWOTE in respect of the period between the relevant earlier time and the later time; and

(b) the estimate or estimates show an overall increase (expressed as a percentage) in those earnings over that period, or over the part of that period in respect of which the estimate or estimates were published;

the annual rate of salary payable to the person at the later time is taken to be the annual rate of salary worked out under subsection (3B) or (3C), as the case requires, increased by that percentage.

(3E) If, at any time, whether before or after the commencement of this subsection, the Australian Statistician has published or publishes for a particular period an estimate of a change (including an estimate that no change has occurred) in AWOTE in substitution for an estimate of such a change for that period previously published by the Australian Statistician, the publication of the later estimate is to be disregarded for the purposes of this section.

19 Section 14A

Repeal the section.

20 Saving of modifications in force under section 14A of the Superannuation Act 1976

(1) Despite the repeal of section 14A of the Superannuation Act 1976 effected by item 19, the modifications of that Act made by regulations in force under subsection (3) of that section immediately before the repeal continue to apply in relation to people to whom those modifications applied at that time.

(2) The power to make regulations conferred by section 168 of the Superannuation Act 1976 extends to making provision for additions to, variations of, or omissions from, any modifications that are continued in force by subitem (1), but the regulations may only make such provision to the extent that the additions, variations or omissions could have been made under section 14A if that section had not been repealed.

21 Subparagraph 47(1)(b)(ii)

Repeal the subparagraph, substitute:

(ii) his or her annual rate of salary had been increased during the period by the same percentage as any overall percentage increase in AWOTE that occurred over the period (being an overall percentage increase worked out from estimates of changes in AWOTE in respect of the period published by the Australian Statistician, other than estimates published in substitution for earlier estimates);

22 Subsection 47(1)

Omit all the words from and including "For the purposes of subparagraph (b)(ii)".

23 Subparagraph 47(3)(d)(ii)

Repeal the subparagraph, substitute:

(ii) his or her annual rate of salary had been increased during the period by the same percentage as any overall percentage increase in AWOTE that occurred over the period (being an overall percentage increase worked out from estimates of changes in AWOTE in respect of the period published by the Australian Statistician, other than estimates published in substitution for earlier estimates);

24 Subsection 47(3)

Omit all the words from and including "For the purposes of subparagraph (d)(ii)".

25 Application

The amendments made by items 21 to 24 apply only in respect of an anniversary of an eligible employee's birth that occurs after 30 June 2003, and the Superannuation Act 1976 as in force immediately before the commencement of those amendments continues to apply in respect of anniversaries that occurred on or before that date as if the amendments had not been made.

26 Section 48

Repeal the section, substitute:

48 Supplementary contributions

An eligible employee may, on any contribution day, pay a supplementary contribution of such amount as the employee determines.

27 At the end of subsection 51(1)

Add:

; and (d) where the period of leave of absence starts after 30 June 2003--the person's designated employer has stopped making payments to the Commonwealth in respect of benefits that become payable under this Act to or in respect of the person.

28 Paragraph 51(2)(e)

Repeal the paragraph.

29 Application

(1) The amendments made by items 27 and 28 apply only in respect of periods of leave of absence beginning on or after 1 July 2003 and, despite the amendments, section 51 of the Superannuation Act 1976 as in force immediately before the commencement of those amendments continues to apply in respect of periods of leave of absence beginning before that date as if the amendments had not been made.

(2) If a person was granted leave of absence before 1 July 2003 for a period (the relevant period ) beginning before that date but ending on or after that date, the reference in subitem (1) to periods of leave of absence beginning before that date:

(a) includes a reference to the part of the relevant period that occurs on or after that date; but

(b) does not include a reference to the period of any extension of the relevant period that is granted on or after that date.

30 Paragraphs 62(2C)(a) and (b)

Repeal the paragraphs, substitute:

(a) to have an amount equal to the lump sum benefit mentioned in subsection (2B) treated as a preserved benefit under the SIS Act and dealt with accordingly; or

(b) to payment of an amount equal to the amount of the person's accumulated contributions and to have an amount equal to the balance of the lump sum benefit mentioned in subsection (2B) treated as a preserved benefit under the SIS Act and dealt with accordingly.

31 Subsections 62B(1) and (2)

Repeal the subsections, substitute:

(1) If a benefit is payable to a person under subsection 62(2), the portion of that benefit worked out under whichever of subsections (3) and (4) of this section applies is to be treated as a preserved benefit under the SIS Act and dealt with accordingly.

32 Subsection 73A(1) (paragraph (b) of the definition of relevant maximum rate )

Repeal the paragraph, substitute:

(b) 75% of the amount per annum worked out by increasing the final annual rate of salary of the pensioner by the same percentage as any overall percentage increase in AWOTE that occurred during the period since the pensioner ceased to be an eligible employee (being an overall increase worked out from estimates of changes in AWOTE in respect of the period published by the Australian Statistician, other than estimates published in substitution for earlier estimates).

33 Application

The amendment made by item 32 applies only in respect of a period after 30 June 2003 and, despite the amendment, subsection 73A(1) of the Superannuation Act 1976 as in force immediately before the commencement of that amendment continues to apply in respect of periods occurring on or before that date as if the amendment had not been made.

34 Section 110D

Omit "Minister", substitute "Board, in accordance with a method of calculation notified to the Board by the Minister,".

35 Subsections 110R(1) and (2)

Repeal the subsections, substitute:

(1) Subject to subsection (2) and section 110S, if a productivity benefit becomes payable in respect of a person, the benefit is to be treated as a preserved benefit under the SIS Act and dealt with accordingly.

(2) If:

(a) the productivity benefit has become payable because of any of the following:

(i) the person ceased to be an eligible employee on or after reaching the age of 60 years;

(ii) if the person has reached the age of 55 years--the person is taken, under subsection 58(2), to have retired voluntarily;

(iii) if the person has reached the age of 55 years and has not made an election under section 137--the person is taken, under subsection 58(3), or under section 58A or 58B, to have retired involuntarily;

(iv) the person retired on the ground of invalidity; and

(b) the person is entitled to receive an additional age retirement pension or an additional early retirement pension; and

(c) the person has not made an election under section 64 to commute his or her pension into a lump sum benefit;

the person may elect to have applied, for the provision of additional age retirement pension or additional early retirement pension, so much of the productivity benefit as will not result in the base amount within the meaning of section 57, 57AA, 61 or 61AB (whichever is applicable) being greater than the maximum amount within the meaning of section 57, 57AA, 61 or 61AB (whichever is applicable).

36 Subsections 110R(4) to (9)

Repeal the subsections.

37 Subsection 110SB(1) (at the end of the definition of other vested benefit )

Add:

; (d) if a benefit is payable in respect of the person under Subdivision B of Division 2 of Part IX--the amount equal to that benefit.

38 Sections 110SG, 110SH and 110SJ

Repeal the sections, substitute:

110SG Payment of top - up benefit

If top - up benefit becomes payable in respect of a person, the Board must:

(a) subject to paragraph (b)--treat the benefit as a preserved benefit under the SIS Act and deal with it accordingly; or

(b) if the person has died:

(i) pay the benefit to his or her legal personal representative; or

(ii) if no legal personal representative can be found--pay the benefit to any individual or individuals that the Board determines.

39 After paragraph 110TA(1)(c)

Insert:

and (d) any benefit that is, or is about to become, payable in respect of the person under Subdivision B of Division 2 of Part IX;

40 Paragraph 110TC(2)(c)

Repeal the paragraph, substitute:

(c) the following subparagraphs applied in respect of the period starting on the day when the person became a person mentioned in subsection 110TC(1) and ending on the day immediately before the day on which the benefit became payable:

(i) in respect of so much of the period as occurred before 1 July 2003--account were taken of any generally - applying increase (including an increase resulting from the process of work - place bargaining) in annual rate of salary that would have occurred had the person continued to be an eligible employee and continued to occupy the office or position in respect of which the person's final annual rate of salary was calculated, other than an excluded increase;

(ii) in respect of so much of the period as occurred on or after 1 July 2003--the person's annual rate of salary had been increased by the same percentage as any overall percentage increase in AWOTE that occurred over the period (being an overall percentage increase worked out from estimates of changes in AWOTE in respect of the period published by the Australian Statistician, other than estimates published in substitution for earlier estimates).

41 Paragraph 110TD(b)

After "and VIAB", insert "and Subdivision B of Division 2 of Part IX".

Note: The heading to section 110TD is omitted and replaced by " Application of Parts VI, VIA and VIAB and Subdivision B of Division 2 of Part IX in relation to postponed benefits ".

42 After paragraph 110TF(f)

Insert:

and (g) the benefit (if any) payable in respect of the deceased person under Subdivision B of Division 2 of Part IX;

43 Paragraph 110TG(1)(a)

Omit "or Part VIA or VIAB", substitute ", Part VI or VIAB or Subdivision B of Division 2 of Part IX".

44 Subsection 111A(2)

Omit all the words after "lump sum,", substitute "the benefit is to be treated as a preserved benefit under the SIS Act and dealt with accordingly".

45 After paragraph 111(2)(ba)

Insert:

and (bb) if a benefit is payable in respect of the person under Subdivision B of Division 2 of Part IX--that benefit;

46 Paragraph 126A(3)(c)

After "Part VIAB", insert "or Subdivision B of Division 2 of Part IX".

47 After the heading to Division 2 of Part IX

Insert:

Subdivision A -- Transfer values

48 At the end of Division 2 of Part IX

Add:

Subdivision B -- Transferred amounts

In this Subdivision:

"transferred amount" , in relation to a person, means:

(a) an amount paid to or in respect of the person after 30 June 2003 by a superannuation entity, other than an amount paid because of the person's physical or mental incapacity to perform his or her duties; or

(b) an amount paid to or in respect of the person after 30 June 2003 that is an eligible termination payment for the purposes of Subdivision AA of Division 2 of Part III of the Income Tax Assessment Act 1936 ; or

(c) an amount paid to or in respect of the person in accordance with the Superannuation Guarantee (Administration) Act 1992 upon the cessation of his or her employment;

but does not include an amount paid to the Board as a result of an election referred to in paragraph 128(1)(b).

130B Transferred amount may be paid to Board

(1) An eligible employee who, whether before or after becoming an eligible employee, receives a transferred amount may pay an amount equal to the transferred amount to the Board.

(2) The Board is to pay into the Fund any transferred amounts received by it.

130C Person's entitlement to benefit

If an amount has been paid into the Fund under section 130B in respect of a person, the person is entitled to a benefit under this Subdivision if another benefit to which the person is entitled under this Act becomes payable.

(1) Subject to subsection (2), the amount of the benefit payable in respect of a person under this Subdivision is the sum of:

(a) an amount equal to the difference between:

(i) the total amount that was paid into the Fund in respect of the person under section 130B; and

(ii) the sum of any amounts in the nature of income tax relevant to that amount; and

(b) interest on the amount mentioned in paragraph (a).

(2) If the person's surcharge debt account is in debit when the benefit becomes payable to the person, the benefit to which the person is entitled is equal to the difference between:

(a) the benefit to which the person would be entitled if this subsection did not apply to the person; and

(b) the person's surcharge deduction amount.

130E Payment of benefit to spouse etc.

(1) If, because of a person's death:

(a) a benefit becomes payable in respect of the person under this Subdivision; and

(b) Part VI applies;

then:

(c) if the person is survived by a spouse--the benefit is payable to the spouse; or

(d) if orphan benefit is payable to an eligible child or eligible children--the benefit is payable to:

(i) the eligible child or eligible children; or

(ii) if the orphan benefit is payable under section 115 to another person or other persons--that person or those persons.

(2) If, because of a person's death:

(a) a benefit becomes payable in respect of the person under this Subdivision; and

(b) a deferred benefit by way of spouse's benefit is payable in respect of the person;

the benefit under this Subdivision is payable to the spouse.

(3) If, because of a person's death:

(a) a benefit becomes payable in respect of the person under this Subdivision; and

(b) a deferred benefit by way of orphan benefit is payable in respect of the person;

the benefit under this Subdivision is payable to:

(c) the eligible child or eligible children entitled to the deferred benefit; or

(d) if the deferred benefit is payable under section 115 to another person or other persons--that person or those persons.

130F Payment of benefit to personal representatives etc.

If:

(a) because of a person's death, a benefit is payable in respect of a person under this Subdivision; and

(b) the person is not survived by any spouse; and

(c) there is no surviving child of the person or no surviving child of the person who could be at any time an eligible child of the person;

the benefit is payable to the person's legal personal representative or, if no legal personal representative can be found, to any individual or individuals that the Board determines.

49 Subsection 134(1)

Omit "subsection (5)", substitute "subsections (4A) and (5)".

50 After subsection 134(4)

Insert:

(4A) An agreement may not be made under subsection (1) after 30 June 2003 .

51 At the end of section 134

Add:

(10) If the Board is satisfied that an eligible superannuation scheme that has ceased to exist was, upon so ceasing to exist, replaced by another superannuation scheme, the Board may determine that the other scheme is an eligible superannuation scheme for the purposes of this Division.

52 At the end of subsection 135(1)

Add:

; and (e) the amount of benefit (if any) payable in respect of the person under Subdivision B of Division 2 of Part IX.

53 Subparagraph 136(2)(b)(iii)

Omit "if an event mentioned in subsection 139AA(2) has not happened in relation to the person", substitute "if, under the SIS Act, the benefit referred to in section 139AA is not to be paid in cash to the person".

54 Subparagraph 136(2)(b)(iv)

Omit "if such an event has happened in relation to the person before the day on which the deferred benefit becomes payable, or happens on that day", substitute "if, under the SIS Act, that benefit is to be paid in cash to the person".

55 Section 139AA

Repeal the section, substitute:

If, under subsection 138(2), deferred benefits applicable in respect of a person become payable on the day immediately following a date selected under paragraph (c) of that subsection, that part of the deferred benefits that consists of an amount equal to the person's accumulated employer contributions is to be treated as a preserved benefit under the SIS Act and dealt with accordingly.

56 Subparagraph 140(2)(a)(i)

Omit "or Part VIA, VIAA, VIAB or VID", substitute ", Part VIA, VIAA, VIAB or VID or Subdivision B of Division 2 of Part IX".

57 Sub - subparagraph 140(2)(a)(ii)(A)

Omit "or Part VIA or VIAB", substitute ", Part VIA or VIAB or Subdivision B of Division 2 of Part IX".

58 Sub - subparagraph 140(2)(a)(ii)(B)

Omit "or Part VIA, VIAB or VID", substitute ", Part VIA, VIAB or VID or Subdivision B of Division 2 of Part IX".

59 Paragraph 168(15)(b)

Repeal the paragraph, substitute:

(b) for the purposes of subsection 3(1AA);

60 Paragraph 240(1)(a)

After "Part VIAB", add "or Subdivision B of Division 2 of Part IX".

61 Paragraph 246(b)

After "110SQ", insert "or 130E".

Part 2 -- Amendments relating to marital status of deceased retirement pensioner

62 Subsection 3(1) (paragraph (a) of the definition of eligible child )

Repeal the paragraph, substitute:

(a) is a child of the deceased person; and

63 Subsection 3(1)

Insert:

"late short-term marital relationship" , in relation to a deceased retirement pensioner, means a marital relationship between the pensioner and his or her spouse that began:

(a) less than 3 years before the pensioner's death; and

(b) after the pensioner became a retirement pensioner and had reached the age of 60 years.

Note: For marital relationship see section 8A and for spouse see section 8B.

64 Subsection 3(1) (paragraph (a) of the definition of partially dependent child )

Repeal the paragraph, substitute:

(a) who is a child (other than an eligible child) of the deceased person; and

65 Subsection 8B(2)

Repeal the subsection, substitute:

(2) For the purposes of this Act, a person is a spouse who survives a deceased person if the person had a marital relationship with the deceased person at the time of the death of the deceased person (the death ).

66 Paragraph 8B(3)(c)

Repeal the paragraph.

67 Section 9

Repeal the section.

68 Subsection 93(1)

Before "entitled", insert ", subject to section 95A,".

69 Subsection 93(2)

Before "entitled", insert ", subject to section 96AA,".

70 After subsection 94(2)

Insert:

(2A) If the spouse of the deceased pensioner had a late short - term marital relationship with the pensioner, spouse's standard pension is payable to the spouse at the rate applicable under section 96AB.

71 Before subsection 95(2)

Insert:

(1B) If the spouse of the deceased pensioner had a late short - term marital relationship with the pensioner, spouse's additional pension is payable to the spouse at the rate applicable under section 96AB.

72 After section 95

Insert:

95A Lump sum instead of spouse's standard pension etc.

(1) If:

(a) the annual rate at which spouse's standard pension is payable to a person under subsection 94(2A); or

(b) if the person is entitled to spouse's additional pension under subsection 95(1B)--the combined annual rate of the spouse's standard pension and the spouse's additional pension payable to the person;

is less than the annual rate determined in writing by the Board for the purposes of this section, the person may, not later than 3 months after the pension or pensions become payable, by notice in writing to the Board, elect to commute the pension or pensions into a lump sum benefit payable to him or her.

(2) If the person makes the election, there is payable to the person, instead of spouse's standard pension, or spouse's standard pension and spouse's additional pension (as the case may be), a lump sum of an amount determined in writing by the Board after consultation with an actuary.

73 Subsection 96(1)

After "is" (last occurring), insert ", subject to subsection (2A),".

74 After subsection 96(2)

Insert:

(2A) If the spouse of the deceased pensioner had a late short - term marital relationship with the pensioner, spouse's pension is payable to the spouse at the rate applicable under section 96AB.

75 After section 96

Insert:

96AA Lump sum instead of spouse's pension

(1) If the annual rate at which spouse's pension is payable to a person under subsection 96(2A) is less than the annual rate determined in writing by the Board for the purposes of this section, the person may, not later than 3 months after the pension becomes payable, by notice in writing to the Board, elect to commute that pension into a lump sum benefit payable to him or her.

(2) If the person makes the election, there is payable to the person, instead of spouse's pension, a lump sum of an amount determined in writing by the Board after consultation with an actuary.

76 At the end of Division 3 of Part VI

Add:

96AB Rate applicable for purposes of certain provisions

(1) If, at any time:

(a) spouse's standard pension under subsection 94(2A); or

(b) spouse's additional pension under subsection 95(1B); or

(c) spouse's pension under subsection 96(2A);

is payable to the spouse of a deceased pensioner, then, for the purposes of whichever of those subsections is applicable, the applicable rate is:

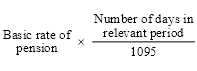

(d) if paragraph (e) does not apply--the rate worked out by using the formula:

(e) if at that time there is one or more than one eligible child who became a child of the pensioner:

(i) before the pensioner became a retirement pensioner or turned 60; or

(ii) at least 3 years before the pensioner died;

--such rate, being a rate higher than the rate worked out under paragraph (d) but less than the basic rate of pension, as the Board determines to be fair and equitable in all the circumstances of the case.

(2) In subsection (1):

"basic rate of pension" means the annual rate at which, apart from subsection (1), spouse's standard pension, spouse's additional pension or spouse's pension (as the case requires) would be payable to the spouse at that time.

"relevant period" means the period:

(a) beginning on the day on which the marital relationship between the deceased pensioner and his or her spouse began; and

(b) ending on the day on which the pensioner died.

77 Subsection 96B(1)

After "subsection (3)", insert "and section 96BA".

Note: The heading to section 96B is altered by adding at the end " --general ".

78 At the end of Division 3A of Part VI

Add:

96BA Extra spouse's pension--special case

(1) If:

(a) the spouse of a deceased pensioner had a late short - term marital relationship with the pensioner; and

(b) apart from this section, the spouse of the deceased pensioner would, at any time, be entitled to extra spouse's pension under subsection 96B(2) or (6);

the annual rate of that pension at that time is:

(c) if paragraph (d) does not apply--the amount worked out by using the formula:

(d) if at that time there is one or more than one eligible child or partially dependent child who became a child of the pensioner:

(i) before the pensioner became a retirement pensioner or turned 60; or

(ii) at least 3 years before the pensioner died;

--such rate, being a rate higher than the rate worked out under paragraph (c) but less than the basic rate of pension, as the Board determines to be fair and equitable in all the circumstances of the case.

(2) In subsection (1):

"basic rate of pension" means the annual rate at which, apart from subsection (1), extra spouse's pension would be payable to the person.

"relevant period" means the period:

(a) beginning on the day on which the marital relationship between the deceased pensioner and his or her spouse began; and

(b) ending on the day on which the pensioner died.

96BB Lump sum instead of extra spouse's pension

If:

(a) instead of a pension under Division 3 of this Part, a lump sum benefit is payable to the spouse of a deceased pensioner under section 95A or 96AA; and

(b) had the pension been payable to the spouse, extra spouse's pension would be payable to him or her under section 96B;

there is payable to the spouse, instead of that extra spouse's pension, a lump sum of an amount determined in writing by the Board after consultation with an actuary.

79 Subsection 105(1)

After "then,", insert "subject to section 108A,".

80 Subsection 106(1)

After "then,", insert "subject to section 108A,".

81 Subsection 107(1)

After "then,", insert "subject to section 108A,".

82 Subsection 108(1)

After "then,", insert "subject to section 108A,".

83 After section 108

Insert:

108A Orphan benefit reduced if deceased pensioner had marital relationship of less than 3 years etc.

(1) This section applies to the eligible child or eligible children of a deceased retirement pensioner if the child, or at least one of the children, is a child of the pensioner because of a late short - term marital relationship between the pensioner and his or her spouse.

(2) This section also applies to the eligible child or eligible children of a deceased retirement pensioner if:

(a) the child, or at least one of the children, became a child of the pensioner only because he or she was an adopted child, foster child or ward of the pensioner; and

(b) he or she had been such an adopted child, foster child or ward for a period of less than 3 years before the pensioner's death.

(3) Orphan pension is payable in respect of a person or persons to whom this section applies only in accordance with this section.

(4) If, apart from this section, orphan pension would at any time be payable under section 105, 106, 107 or 108 in respect of a person or persons to whom this section applies, the annual rate of that pension at that time is:

(a) if paragraph (b) does not apply--the amount worked out by using the formula:

(b) if at that time there is one or more than one eligible child who is not a child referred to in subsection (1) or (2)--such rate, being a rate higher than the rate worked out under paragraph (a) but less than the basic rate of pension, as the Board determines to be fair and equitable in all the circumstances of the case.

(5) In subsection (4):

"basic rate of pension" means the annual rate at which, apart from this section, orphan pension would be payable at that time in respect of the person under subsection 105(2), 106(2), 107(2) or 108(2).

"relevant period" means the period:

(a) beginning on the day on which:

(i) the marital relationship between the deceased pensioner and his or her spouse began; or

(ii) the child, or one of the children, first became an adopted child, foster child or ward of the pensioner; and

(b) ending on the day on which the pensioner died.

84 Paragraph 109AB(2)(c)

Repeal the paragraph, substitute:

(c) if the deceased person was, immediately before his or her death, a retirement pensioner and had had a marital relationship that had begun:

(i) before he or she had become a retirement pensioner; or

(ii) before he or she had turned 60; or

(iii) not less than 3 years before the pensioner's death;

--the applicable percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death.

85 Before subsection 109AB(4)

Insert:

(3B) If the deceased person:

(a) was, immediately before his or her death, a retirement pensioner; and

(b) had had a late short - term marital relationship with his or her spouse;

the amount of the spouse's pension payable to the spouse must not exceed such percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death as is determined by the Board.

(3C) In making a determination under subsection (3B), the Board must take into consideration:

(a) the extent to which spouse's pension payable to the spouse of a deceased pensioner under Division 3 is reduced when the spouse and the deceased pensioner have been in a marital relationship of the kind referred to in paragraph (3B)(b); and

(b) whether one or more than one eligible child, or one or more than one partially dependent child, of the pensioner is or is not a child of the pensioner because of the late short - term marital relationship referred to in paragraph (3B)(b).

86 Subsection 109AB(4)

After "(5)", insert ", (5A)".

87 Paragraph 109AB(5)(c)

Repeal the paragraph, substitute:

(c) if the deceased person was, immediately before his or her death, a retirement pensioner and had had a marital relationship that had begun:

(i) before he or she had become a retirement pensioner; or

(ii) before he or she had turned 60; or

(iii) not less than 3 years before the pensioner's death;

--the applicable percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death.

88 After subsection 109AB(5)

Insert:

(5A) If the deceased person:

(a) was, immediately before his or her death, a retirement pensioner; and

(b) had had a late short - term marital relationship with his or her spouse;

benefit attributed under subsection (4) to the eligible child or eligible children of the deceased person not in the custody, care and control of the spouse must not exceed in the aggregate such proportion of the applicable percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death as is determined by the Board.

(5B) In making a determination under subsection (4) or (5A), the Board must take into consideration:

(a) the extent to which spouse's pension payable to the spouse of a deceased pensioner under Division 3 is reduced when the spouse and the deceased pensioner have been in a marital relationship of the kind referred to in paragraph (5A)(b); and

(b) whether one or more than one eligible child of the pensioner is or is not a child of the pensioner because of the late short - term marital relationship referred to in paragraph (5A)(b).

89 Paragraph 109AB(7)(b)

After "(5)", insert "or (5A)".

90 Paragraph 110(4)(c)

Repeal the paragraph, substitute:

(c) if the deceased person was, immediately before his or her death, a retirement pensioner and had had a marital relationship with the spouse that had begun:

(i) before the retirement pensioner had become a retirement pensioner; or

(ii) before the retirement pensioner had turned 60; or

(iii) not less than 3 years before the pensioner's death;

--the applicable percentage of the annual rate of pension payable to the retirement pensioner before his or her death; or

(d) if the deceased pensioner was, immediately before his or her death, a retirement pensioner and had had a late short - term marital relationship with the spouse--such percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death as is determined by the Board.

91 Before subsection 110(6)

Insert:

(5B) In making a determination under paragraph (4)(d), the Board must take into consideration:

(a) the extent to which spouse's pension payable to the spouse of a deceased pensioner under Division 3 is reduced when the spouse and the deceased pensioner have been in a marital relationship of the kind referred to in paragraph (4)(d); and

(b) whether there is in the custody, care and control of the spouse one, or more than one, eligible child who:

(i) was not born of the marital relationship referred to in paragraph (4)(d); or

(ii) did not become a stepchild of the pensioner as a result of that marital relationship; or

(iii) is not a child of the person with whom the pensioner had that marital relationship.

92 Paragraph 110(7)(c)

Repeal the paragraph, substitute:

(c) if the deceased person was, immediately before his or her death, a retirement pensioner and had been in a marital relationship that had begun:

(i) before he or she had become a retirement pensioner; or

(ii) before he or she had turned 60; or

(iii) not less than 3 years before the pensioner's death;

the applicable percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death.

93 After subsection 110(7)

Insert:

(7A) If:

(a) the deceased person:

(i) was, immediately before his or her death, a retirement pensioner; and

(ii) had had a late short - term marital relationship; and

(b) one or more than one eligible child of the pensioner:

(i) was born of that marital relationship; or

(ii) became a stepchild of the pensioner as a result of that marital relationship; or

(iii) is a child of the person with whom the pensioner had that marital relationship; and

(c) that child or any of those children is not in the custody, care and control of any of the surviving spouses;

the following provisions apply:

(d) benefit attributed under subsection (6) to that child or to each of those children should be less than the amount of benefit that would be attributed to him or her if he or she were an eligible child other than a child referred to in paragraph (b);

(e) benefit attributed under subsection (6) to the eligible child or eligible children of the deceased person not in the custody, care and control of any of the surviving spouses must not exceed in the aggregate such proportion of the applicable percentage of the annual rate of pension payable to the retirement pensioner immediately before his or her death as is determined by the Board.

(7B) In making a determination under subsection (6) as affected by paragraph (7A)(d) or under paragraph (7A)(e), the Board must take into consideration:

(a) the extent to which spouse's pension payable to the spouse of a deceased pensioner under Division 3 is reduced when the spouse and the deceased pensioner have been in a marital relationship of the kind referred to in paragraph (7A)(a); and

(b) whether the eligible child or any of the eligible children not in the custody of any surviving spouse was or was not a child referred to in paragraph (7A)(b).

94 Paragraph 110(9)(b)

After "(7)", insert "or (7A)".

95 Paragraph 136(2B)(j)

After "94", insert ", then, except if paragraph (ma) applies".

96 Paragraph 136(2B)(k)

After "95", insert ", then, except if paragraph (ma) applies".

97 Paragraph 136(2B)(m)

After "96", insert ", then, except if paragraph (ma) applies".

98 After paragraph 136(2B)(m)

Insert :

(ma) if:

(i) a deferred benefit by way of spouse's standard pension, spouse's additional pension or spouse's pension is payable in respect of the person in accordance with section 94, 95 or 96 (as the case may be); and

(ii) the person had had a late short - term marital relationship with his or her spouse;

the annual rate of that pension is:

(iii) if subparagraph (iv) does not apply--the rate worked out by using the formula:

(iv) if there is one or more than one eligible child who did not become a child of the person because of that late short - term marital relationship--such rate, being a rate higher than the rate worked out under subparagraph (iii) but less than the basic rate of pension, as the Board determines to be fair and equitable in all the circumstances of the case;

where:

basic rate of pension means the annual rate at which, apart from this paragraph, the deferred benefit would be payable in respect of the person under paragraph (j), (k) or (m) (whichever would be applicable).

relevant period means the period:

(a) beginning on the day on which the marital relationship between the person and his or her spouse began; and

(b) ending on the day on which the person died.

99 At the end of subsection 136(2B)

Add:

; (zb) if a deferred benefit by way of orphan's pension is payable in respect of the person in accordance with section 108A, the annual rate of that pension is:

(i) if subparagraph (ii) does not apply--the rate worked out by using the formula:

(ii) if at any time there is one or more than one eligible child who is not a child referred to in subsection 108A(1) or (2)--such rate, being a rate higher than the rate worked out under subparagraph (i) but less than the basic rate of pension, as the Board determines to be fair and equitable in all the circumstances of the case;

where:

basic rate of pension means the annual rate at which the deferred benefit by way of orphan pension would be payable in respect of the person under paragraph (w), (y) or (za) (whichever would be applicable) if the deferred benefit was not payable in respect of the person in accordance with section 108A but was payable in respect of the person in accordance with section 105, 106, 107 or 108 (as the case may be).

relevant period has the same meaning as in section 108A .

100 Paragraph 136(2D)(d)

After "96B", insert "or 96BA".

101 Beneficiaries not to be adversely affected by amendments

Despite the amendments made by this Part, the benefits payable in respect of a deceased pensioner under Part VI of the Superannuation Act 1976 after the commencement of this item must not be less than the benefits that would have been payable in respect of the pensioner under that Part if the amendments had not been made.

102 Subsection 3(1)

Insert:

"category 1 deceased pensioner" means a deceased pensioner who:

(a) before his or her death, was entitled to receive age retirement pension or early retirement pension; and

(b) had not elected under section 57AA or 61AB (as the case may be) to be paid that pension at a reduced rate.

103 Subsection 3(1)

Insert:

"category 2 deceased pensioner" means a deceased pensioner who:

(a) before his or her death, was entitled to receive age retirement pension or early retirement pension; and

(b) had elected under section 57AA or 61AB (as the case may be) to be paid that pension at a reduced rate.

104 At the end of paragraph 55(1)(a)

Add "or paragraph 57AA(2)(a); and".

105 Paragraph 55(1)(b)

After "57(1)", insert "or paragraph 57AA(2)(b)".

106 At the end of paragraph 55(1)(c)

Add "or paragraph 57AA(2)(c)".

107 At the end of paragraph 55(2)(a)

Add "or paragraph 57AA(2)(a); and".

108 Paragraph 55(2)(b)

After "57(1)", insert "or paragraph 57AA(2)(b)".

109 At the end of paragraph 55(2)(c)

Add "or paragraph 57AA(2)(c)".

110 Before subsection 56(1)

Insert:

(1A) This section does not apply to a person who makes an election under subsection 57AA(1).

111 Before subsection 57(1)

Insert:

(1A) This section does not apply to a person who makes an election under subsection 57AA(1).

112 After section 57

Insert:

57AA Election to receive age retirement benefit at reduced rate

(1) Subject to subsection (2), a person who becomes, or is about to become, entitled to standard age retirement pension payable under this Division may, not later than 3 months after but not earlier than 3 months before he or she becomes so entitled, by notice in writing to the Board, elect to be paid age retirement benefit at a reduced rate under this section.

(2) A person who has made an election under section 76A or 110T may not make an election under subsection (1).

(3) If a person makes an election under section 110T after making an election under subsection (1), the person is taken not to have made the election under subsection (1).

(4) If a person makes an election under subsection (1):

(a) the annual rate at which standard age retirement pension is payable to the person is 93% of the annual rate at which that pension would be payable to the person if he or she did not make the election; and

(b) if the person is entitled to additional age retirement pension, the annual rate of that pension is:

(i) an amount per annum equal to the amount ( base amount ) worked out by multiplying the person's accumulated contributions by the factor that, having regard to the person's age on his or her last day of service and such other matters (if any) as are prescribed, is applicable to the person under regulations made for the purposes of this paragraph; or

(ii) if the rate worked out under subparagraph (i) is greater than 20% of his or her final annual rate of salary--20% of the person's final annual rate of salary; and

(c) if the base amount is greater than an amount ( maximum amount ) equal to 20% of the person's final annual rate of salary, the person is to be paid a lump sum benefit equal to the amount by which his or her accumulated contributions exceed an amount worked out by dividing the maximum amount by the factor referred to in subparagraph (b)(i).

113 At the end of paragraph 59(1)(a)

Add "or paragraph 61AB(2)(a); and".

114 At the end of paragraph 59(1)(b)

Add "or paragraph 61AB(2)(b)".

115 At the end of paragraph 59(1)(c)

Add "or paragraph 61AB(2)(c)".

116 Before subsection 60(1)

Insert:

(1A) This section does not apply to a person who makes an election under subsection 61AB(1).

117 Before subsection 61(1)

Insert:

(1AA) This section does not apply to a person who makes an election under subsection 61AB(1).

118 After section 61A

Insert:

61AB Election to receive early retirement benefit at reduced rate

(1) Subject to subsection (2), a person who becomes, or is about to become, entitled to standard early retirement pension under this Division or Subdivision C of Division 3 of Part VIC may, not later than 3 months after but not earlier than 3 months before he or she becomes so entitled, by notice in writing to the Board, elect to be paid early retirement benefit at a reduced rate under this section.

(2) A person who has made an election under section 76A or 110T may not make an election under subsection (1).

(3) If a person makes an election under section 110T after making an election under subsection (1), the person is taken not to have made the election under subsection (1).

(4) If a person makes an election under this section:

(a) the annual rate at which standard early retirement pension is payable to the person is 93% of the annual rate at which that pension would be payable to the person if he or she did not make the election; and

(b) if the person is entitled to additional early retirement pension, the annual rate of that pension is:

(i) an amount per annum equal to the amount ( base amount ) worked out by multiplying the person's accumulated contributions by the factor applicable to him or her under subsection (5); or

(ii) if the rate worked out under subparagraph (i) is greater than 20% of the person's notional final annual rate of salary--20% of his or her notional final annual rate of salary; and

(c) if the base amount is greater than an amount ( maximum amount ) equal to 20% of the person's final annual rate of salary, the person is to be paid a lump sum benefit equal to the amount by which his or her accumulated contributions exceed an amount worked out by dividing the maximum amount by the factor applicable to him or her under subsection (5).

(5) The factor applicable to a person for the purposes of paragraphs (4)(b) and (c) is the factor that, having regard to his or her age on his or her last day of service and such other matters (if any) as are prescribed, is applicable to him or her under regulations made for the purposes of this subsection.

(6) In this section:

"notional final annual rate of salary" , in relation to a person, means the annual rate of the person's final annual rate of salary reduced by the percentage of that rate that, having regard to his or her age on his or her last day of service and such other matters (if any) as are prescribed, is applicable to him or her under regulations made for the purposes of this definition.

119 Subsection 65(2)

Omit "or 61(2)" (wherever occurring), substitute ", paragraph 57AA(2)(c), subsection 61(2) or paragraph 61AB(2)(c)".

120 Subsections 94(1) and (2)

Repeal the subsections, substitute:

(1) If, at any time, the spouse of a category 1 deceased pensioner is entitled to spouse's standard pension under paragraph 93(1)(a), then, subject to subsection (2A), the annual rate of that pension is:

(a) if at that time there are no children of the pensioner who are eligible children--67% of the annual rate ( pensioner rate ) at which standard age retirement pension or standard early retirement pension (as the case may be) was payable to the pensioner immediately before his or her death; or

(b) if at that time only one child of the pensioner is an eligible child--78% of the pensioner rate; or

(c) if at that time 2 children of the pensioner are eligible children--89% of the pensioner rate; or

(d) if at that time 3 or more children of the pensioner are eligible children--100% of the pensioner rate.

(2) If, at any time, the spouse of a category 2 deceased pensioner is entitled to spouse's standard pension under paragraph 93(1)(a), then, subject to subsection (2A), the annual rate of that pension is:

(a) if at that time there are no children of the pensioner who are eligible children--85% of the annual rate ( pensioner rate ) at which standard age retirement pension or standard early retirement pension (as the case may be) was payable to the pensioner immediately before his or her death; or

(b) if at that time only one child of the pensioner is an eligible child--97% of the pensioner rate; or

(c) if at that time 2 or more children of the pensioner are eligible children--108% of the pensioner rate.

121 Subsection 94(3)

Repeal the subsection, substitute:

(3) Despite subsections (1), (2) and (2A), if, on any of the 7 pension pay days immediately following the death of the pensioner, spouse's standard pension would, apart from this subsection, be payable to the spouse of the deceased pensioner at a rate that is less than the rate ( pensioner rate ) at which standard age retirement pension or standard early retirement pension (as the case may be) would be payable to the deceased pensioner on that day if he or she had not died, spouse's standard pension is payable to the spouse on that day at a rate equal to the pensioner rate.

122 Subsection 95(1)

Repeal the subsection, substitute:

(1) If the spouse of a category 1 deceased pensioner is entitled to spouse's additional pension under paragraph 93(1)(b), then, subject to subsection (1B), the annual rate of that pension is 67% of the annual rate at which additional age retirement pension or additional early retirement pension was payable to the pensioner immediately before his or her death.

(1A) If the spouse of a category 2 deceased pensioner is entitled to spouse's additional pension under paragraph 93(1)(b), then, subject to subsection (1B), the annual rate of that pension is 85% of the annual rate at which additional age retirement pension or additional early retirement pension was payable to the pensioner immediately before his or her death.

123 Subsection 95(2)

Repeal the subsection, substitute:

(2) Despite subsections (1), (1A) and (1B), if:

(a) the pensioner did not make an election under section 64; and

(b) on any of the 7 pension pay days immediately following the death of the pensioner, spouse's additional pension would, apart from this subsection, be payable to the spouse of the deceased person at a rate that is less than the rate ( pensioner rate ) at which additional age retirement pension or additional early retirement pension (as the case may be) would be payable to the deceased pensioner on that day if he or she had not died;

spouse's additional pension is payable to the spouse on that day at a rate equal to the pensioner rate.

124 Paragraph 96B(1)(b)

Omit "section 94 or 96", substitute "subsection 94(1) or section 96".

125 Subsection 96B(2)

After "pension" (first occurring), insert "under subsection (1)".

126 Paragraph 96B(2)(a)

Omit ", 90, 94 or 96", substitute "or 90, subsection 94(1) or section 96".

127 Subsection 96B(3)

After "pension", insert "under subsection (1)".

128 Subsection 96B(4)

After "pension", insert "under subsection (1)".

129 At the end of section 96B

Add:

(5) If, at any time when spouse's pension is payable to the spouse of a deceased pensioner in accordance with subsection 94(2), there is one, or more than one, child of the deceased pensioner who is a partially dependent child, then, subject to subsection (7) and section 96BA, the spouse is entitled to extra spouse's pension in accordance with subsection (6).

(6) If, at any time, the spouse of a deceased pensioner is entitled to extra spouse's pension under subsection (5), the annual rate of that pension is:

(a) the applicable percentage of the annual rate of the pension by reference to which the spouse's pension payable to the spouse under subsection 94(2) is to be calculated under that subsection; or

(b) an amount equal to the amount per annum of the regular maintenance payments that the deceased pensioner was, at the time of his or her death, voluntarily making, or required by a court to make, to or in respect of the partially dependent child or children;

whichever is less.

(7) The spouse of a deceased pensioner is not entitled to extra spouse's pension under subsection (5) at any time when there is more than one child of the deceased pensioner who is an eligible child.

(8) If, at any time, the spouse of a deceased pensioner is entitled to extra spouse's pension under subsection (5), then, for the purposes of subsection (6), the applicable percentage is:

(a) if, at that time, one child of the deceased pensioner is an eligible child--11%; or

(b) if, at that time, no child of the deceased pensioner is an eligible child:

(i) if there is one partially dependent child--12%; or

(ii) if there are 2 or more partially dependent children--23%.

130 Section 109

Omit "105(2),".

131 Section 109

Omit ", 107(2)".

132 At the end of section 109

Add:

(2) If, at any time, orphan pension is payable in respect of an eligible child or eligible children of a deceased pensioner, then, for the purposes of subsection 105(2) or 107(2), the applicable percentage is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children | Category 1 | Category 2 |

1 | If, at that time, there is 1 eligible child | 45% | 51% |

2 | If, at that time, there are 2 eligible children | 80% | 92% |

3 | If, at that time, there are 3 eligible children | 90% | 108% |

4 | If, at that time, there are 4 or more eligible children | 100% | 108% |

133 Subsection 109AB(3)

Omit "subsection (2)", substitute "paragraphs (2)(a) and (b)".

134 After subsection 109AB(3)

Insert:

(3A) The applicable percentage mentioned in paragraph (2)(c) is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children in custody etc. of spouse | Category 1 | Category 2 |

1 | If there are no eligible children of the deceased person in the custody, care and control of the spouse | 67% | 85% |

2 | If there is one eligible child of the deceased person in the custody, care and control of the spouse | 78% | 97% |

3 | If there are 2 eligible children of the deceased person in the custody, care and control of the spouse | 89% | 108% |

4 | If there are 3 or more eligible children of the deceased person in the custody, care and control of the spouse | 100% | 108% |

135 Subsection 109AB(6)

Omit "subsection (5)", substitute "paragraphs (5)(a) and (b)".

136 After subsection 109AB(6)

Insert:

(6A) The applicable percentage mentioned in paragraph (5)(c) is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children not in custody etc. of spouse | Category 1 | Category

2 |

1 | If there is one eligible child not in the custody, care and control of the spouse | 45% | 51% |

2 | If there are 2 eligible children not in the custody, care and control of the spouse | 80% | 92% |

3 | If there are 3 eligible children not in the custody, care and control of the spouse | 90% | 108% |

4 | If there are 4 or more eligible children not in the custody, care and control of the spouse | 100% | 108% |

137 Subsection 110(5)

Omit "subsection (4)", substitute "paragraphs (4)(a) and (b)".

138 After subsection 110(5)

Insert:

(5A) The applicable percentage mentioned in paragraph (4)(c) is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children in custody etc. of spouse | Category 1 | Category 2 |

1 | If there is no eligible child of the deceased person in the custody, care and control of the spouse | 67% | 85% |

2 | If there is one eligible child of the deceased person in the custody, care and control of the spouse | 78% | 97% |

3 | If there are 2 eligible children of the deceased person in the custody, care and control of the spouse | 89% | 108% |

4 | If there are 3 or more eligible children of the deceased person in the custody, care and control of the spouse | 100% | 108% |

139 Subsection 110(8)

Omit "subsection (7)", substitute "paragraphs (7)(a) and (b)".

140 After subsection 110(8)

Insert:

(8A) The applicable percentage mentioned in paragraph (7)(c) is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children not in custody etc. of spouse | Category 1 | Category 2 |

1 | If there is one eligible child not in the custody, care and control of the spouse | 45% | 51% |

2 | If there are 2 eligible children not in the custody, care and control of the spouse | 80% | 92% |

3 | If there are 3 eligible children not in the custody, care and control of the spouse | 90% | 108% |

4 | If there are 4 or more eligible children not in the custody, care and control of the spouse | 100% | 108% |

141 Paragraphs 110AB(3)(a), (b) and (c)

Repeal the paragraphs, substitute:

(a) in the case of spouses of a category 2 deceased pensioner:

(i) if there are 2 spouses--11%; or

(ii) if there are 3 or more spouses--22%; or

(b) in any other case:

(i) if there are 2 spouses--11%; or

(ii) if there are 3 spouses--22%; or

(iii) if there are 4 or more spouses--33%.

142 Subsection 110R(2)

Omit "or 61" (twice occurring), substitute ", 57AA, 61 or 61AB".

143 After section 110TB

Insert:

110TBA Election to receive age retirement benefit etc. at reduced rate

A person who has made an election under section 110T may, not later than 3 months after, but not earlier than 3 months before, age retirement benefit or early retirement benefit becomes payable to him or her under section 110TB, elect to receive the benefit at a reduced rate.

144 At the end of subsection 110TC(1)

Add:

; and (e) if the person has made an election under section 110TBA--the person is taken to have elected:

(i) to receive age retirement pension at a reduced rate under section 57AA; or

(ii) to receive early retirement benefit at a reduced rate under section 61AB;

as the case requires.

145 Subsection 136(2) (definition of F 1 )

Repeal the definition, substitute:

"F" 1 is such factor as, having regard to:

(a) the age of the person on the day on which the deferred benefits become payable; and

(b) whether or not the person has elected under section 137A that deferred benefits be paid to him or her at a reduced rate;

is applicable in accordance with Table 1 in Schedule 11; and

146 Paragraph 136(2B)(k)

Omit all the words from and including "the annual rate", substitute:

the annual rate of that pension is:

(i) except if subparagraph (ii) applies--67% of the annual rate of the pension that was payable to the person in accordance with paragraph (2)(b) immediately before his or her death; or

(ii) if the person elected under section 137A that deferred benefits be paid to him or her at a reduced rate--85% of the annual rate of that pension;

147 Subsection 136(2G)

Omit ", (j)".

148 After subsection 136(2G)

Insert:

(2GA) If, at any time, a deferred benefit by way of spouse's pension is payable in respect of a person in accordance with section 94, then, for the purposes of paragraph (2B)(j), the applicable percentage is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children | If person did not make election under section 137A | If person made election under section 137A |

1 | If, at that time, there is no eligible child of the person who is an eligible child | 67% | 85% |

2 | If, at that time, one child of the person is an eligible child | 78% | 97% |

3 | If, at that time, 2 children of the person are eligible children | 89% | 108% |

4 | If, at that time, more than 2 children of the person are eligible children | 100% | 108% |

149 Subsection 136(2H)

Omit "(w),".

150 Subsection 136(2H)

Omit ", (z)".

151 After subsection 136(2H)

Insert:

(2HA) If, at any time, a deferred benefit by way of orphan pension is payable in respect of a person in accordance with section 105 or 107, then, for the purposes of paragraph (2B)(w) or (2B)(z) (as the case requires), the applicable percentage is the percentage worked out in accordance with the following table:

Applicable percentage | |||

Item | Number of eligible children | If person did not make election under section 137A | If person made election under section 137A |

1 | If, at that time, one child of the person is an eligible child | 45% | 51% |

2 | If, at that time, 2 children of the person are eligible children | 80% | 92% |

3 | If, at that time, 3 children of the person are eligible children | 90% | 108% |

4 | If, at that time, more than 3 children of the person are eligible children | 100% | 108% |

152 After section 137

Insert:

137A Election to receive deferred benefits at reduced rate

A person who has made an election under section 137 may, within 3 months after deferred benefits become payable to him or her under section 138, elect that those deferred benefits are to be paid to him or her at a reduced rate.

153 Schedule 11, Table 1

Repeal the table, substitute:

Table 1--Factors applicable where benefits payable in accordance with section 56, 57, 60 or 61 | |||

Column 1 | Column 2 | Column 3 | Column 4 |

1 | 65 | .110 | .1030 |

2 | 64 | .108 | .1010 |

3 | 63 | .106 | .0990 |

4 | 62 | .104 | .0970 |

5 | 61 | .102 | .0950 |

6 | 60 | .100 | .0930 |

7 | 59 | .0985 | .0916 |

8 | 58 | .0970 | .0902 |

9 | 57 | .0955 | .0888 |

10 | 56 | .0940 | .0874 |

11 | 55 | .0925 | .0860 |

12 | 54 | .0910 | .0846 |

13 | 53 | .0895 | .0832 |

14 | 52 | .0880 | .0818 |

15 | 51 | .0865 | .0804 |

16 | 50 | .0850 | .0790 |

154 Subsection 3(1)

Insert:

"accumulated performance pay employee contributions" , in relation to a person, means the sum of:

(a) an amount equal to the difference between:

(i) the sum of the amounts paid into a declared fund (within the meaning of the Superannuation (Productivity Benefit) Act 1988 ) in respect of the person under paragraph 11(1)(a) of the Superannuation (Productivity Benefit) Alternative Arrangements Declaration No. 6 (Statutory Rules 1993, No. 34); and

(ii) the sum of any amounts deducted by way of charges or fees from those amounts by the trustee of the fund; and

(b) interest on the amount mentioned in paragraph (a).

"accumulated performance pay employer contributions" , in relation to a person, means the sum of:

(a) an amount equal to the difference between:

(i) the sum of the amounts paid into a declared fund (within the meaning of the Superannuation (Productivity Benefit) Act 1988 ) in respect of the person under paragraph 11(1)(b) of the Superannuation (Productivity Benefit) Alternative Arrangements Declaration No. 6 (Statutory Rules 1993, No. 34); and

(ii) the sum of any amounts in the nature of income tax relevant to those amounts and any amounts deducted by way of charges or fees from those amounts by the trustee of the fund; and

(b) interest on the amount mentioned in paragraph (a).

"employer component" , in relation to a benefit payable in respect of a person under Part VIAB, means that part of the benefit that is payable because of:

(a) the accumulated performance pay employer contributions of the person; and

(b) if the person's transferable productivity amount was paid to the Board under section 110SL or was paid first to the trustee of another superannuation entity and then an amount in respect of that transferable productivity amount was paid under section 110SL by that trustee to the Board--the person's transferable productivity amount.

"superannuation entity" has the same meaning as in the SIS Act.

"transferable productivity amount" , in relation to a person whose continuing contributions (within the meaning of the Superannuation (Productivity Benefit) Act 1988 ) are, or were, held in a declared fund (within the meaning of that Act), means the sum of:

(a) an amount equal to the difference between:

(i) the sum of the continuing contributions paid into the declared fund; and

(ii) the sum of any amounts in the nature of income tax relevant to those contributions and any amounts deducted by way of charges or fees from those contributions by the trustee of the declared fund; and

(b) interest on the amount mentioned in paragraph (a).

155 Subsection 110SB(1) (at the end of the definition of other vested benefit )

Add:

; (c) if a benefit is payable in respect of the person under Part VIAB--the amount equal to that benefit.

156 After Part VIAA

Insert:

Part VIAB -- Payment into fund of amounts held in other superannuation funds

110SK Request for transfer of amounts to Board

(1) This section applies to a person if:

(a) the person is an eligible employee; or

(b) deferred benefits are applicable in respect of the person under Division 3 of Part IX; or

(c) either:

(i) the person has elected under subsection 110T(1) that Part VIB apply to him or her; or

(ii) regulation 15, 15A or 15B of the Superannuation (CSS) Former Eligible Employees Regulations applies to the person;

and no benefits under this Act have been paid or begun to be paid to the person;

and the person made an election under clause 6 of the Superannuation (Productivity Benefit) Alternative Arrangements Declaration No. 6 (Statutory Rules 1993, No. 34) to have performance pay taken into account in his or her superannuation arrangements under the Superannuation (Productivity Benefit) Act 1988 .

(2) A person to whom this section applies may, at any time, by notice in writing, ask the trustee of the declared fund (within the meaning of the Superannuation (Productivity Benefit) Act 1988 ) holding the person's accumulated performance pay employee contributions and accumulated performance pay employer contributions to pay those contributions to the Board.

(3) If continuing contributions (within the meaning of the Superannuation (Productivity Benefit) Act 1988 ) have been paid, but are no longer being paid, into the declared fund in respect of a continuous period of employment of the person, the person may, by the same notice, ask the trustee of the declared fund to pay also to the Board the person's transferable productivity amount.

(4) If:

(a) a person's accumulated performance pay employee contributions and accumulated performance pay employer contributions; or

(b) a person's accumulated performance pay employee contributions, accumulated performance pay employer contributions and transferable productivity amount;

have, at the person's request, been paid by the trustee of the declared fund to the trustee of a superannuation entity other than the Fund, the person may, by notice in writing, ask the trustee of that superannuation entity to pay to the Board the sum of:

(c) an amount equal to the difference between:

(i) the total amount paid to the superannuation entity; and

(ii) the sum of any amounts in the nature of income tax relevant to that amount and any amounts deducted by way of charges or fees from that amount by the trustee of the superannuation entity; and

(d) interest on the amount mentioned in paragraph (c).

(5) The person must, as soon as possible, give to the Board notice in writing of any request made to the trustee of a fund or superannuation entity under subsection (2), (3) or (4).

110SL Board to pay amounts into Fund

If, following a request from a person under subsection 110SK(2), (3) or (4), the trustee of a fund or superannuation entity pays an amount to the Board, the Board must pay that amount into the Fund.

110SM Person's entitlement to benefit

If an amount has been paid into the Fund under section 110SL in respect of a person, the person becomes entitled to a benefit under this Part if another benefit to which the person was entitled under this Act becomes payable.

The amount of the benefit payable in respect of a person under this Part is the sum of:

(a) an amount equal to the difference between:

(i) the total amount that was paid into the Fund in respect of the person under section 110SL; and

(ii) the sum of any amounts in the nature of income tax relevant to that amount; and

(b) interest on the amount mentioned in paragraph (a).

The employer component of the benefit to which a person is entitled under this Part is to be treated as a preserved benefit under the SIS Act and the remainder of the benefit is payable to the person.

110SP Payment of benefit to spouse etc.

(1) If, because of a person's death:

(a) a benefit becomes payable in respect of the person under this Part; and

(b) Part VI applies;

then:

(c) if the person is survived by a spouse--the benefit is payable to the spouse; or

(d) if orphan benefit is payable to an eligible child or eligible children--the benefit is payable to:

(i) the eligible child or eligible children; or

(ii) if the orphan benefit is payable under section 115 to another person or other persons--that person or those persons.

(2) If, because of a person's death:

(a) a benefit becomes payable in respect of the person under this Part; and

(b) a deferred benefit by way of spouse's benefit is payable in respect of the person;

the benefit under this Part is payable to the spouse.

(3) If, because of a person's death:

(a) a benefit becomes payable in respect of the person under this Part; and

(b) a deferred benefit by way of orphan benefit is payable in respect of the person;

the benefit under this Part is payable to:

(c) the eligible child or eligible children entitled to the deferred benefit; or

(d) if the deferred benefit is payable under section 115 to another person or other persons--that person or those persons.

110SQ Payment of benefit to personal representatives etc.

If:

(a) because of a person's death, a benefit is payable in respect of a person under this Part; and

(b) the person is not survived by any spouse; and

(c) there is no surviving child of the person or no surviving child of the person who could be at any time an eligible child of the person;

the benefit is payable to the person's legal personal representative or, if no legal personal representative can be found, to any individual or individuals that the Board determines.

157 After paragraph 110TA(1)(b)

Insert:

and (c) any benefit that is, or is about to become, payable in respect of the person under Part VIAB;

158 Paragraph 110TD(b)

Omit "Part VIA applies", substitute "Parts VIA and VIAB apply".

Note: The heading to section 110TD is altered by omitting " and VIA " and substituting " , VIA and VIAB ".

159 Section 110TF

Omit all the words from and including "a lump sum benefit", substitute:

a lump sum benefit equal to the sum of:

(d) the accumulated contributions of the deceased person; and

(e) the accumulated employer contributions in respect of the deceased person; and

(f) the benefit (if any) payable in respect of the deceased person under Part VIAB;

is payable in respect of that child or those children.

160 Paragraph 110TG(1)(a)

After "VIA" (second occurring), insert "or VIAB".

161 After paragraph 111(2)(b)

Insert:

and (ba) if a benefit is payable in respect of the person under Part VIAB--that benefit;

162 Paragraph 126A(3)(c)

After "persons" (first occurring) insert ", or the whole or a part of the benefit (if any) payable under Part VIAB in respect of the person or each or all of those persons,".

163 After subparagraph 128(2)(c)(ii)

Insert:

and (iii) the amount of any part of the benefit payable in respect of the person under Part VIAB included in a transfer value (if any) that was payable to the person under Division 3 of Part IX and interest on that amount;

164 After subparagraph 128(4B)(c)(iii)

Insert:

and (iv) if a benefit is payable in respect of the person under Part VIAB--the employer component of that benefit;

165 At the end of paragraph 128(6)(b)

Add:

; or (iii) if a benefit is payable in respect of the person under Part VIAB--an amount equal to the employer component of that benefit .

166 At the end of subsection 135(1)

Add: