Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subject to subsections (4A), (5), (6), (7), (8) and (8B), if:

(a) the value of a person's liquid assets exceeds the person's maximum reserve on:

(i) if subparagraph 593(1)(a)(ii) does not apply in relation to the person--the day following the day on which the person ceased work or ceased to be enrolled in a full time course of education or of vocational training; or

(ia) if subparagraph 593(1)(a)(ii) applies in relation to the person--the day on which the person becomes incapacitated for work or study; or

(ii) in any case--the day on which the person claims a jobseeker payment; and

(b) the person is not a transferee to a jobseeker payment;

the person is not qualified for a jobseeker payment for a period unless the person has served the liquid assets test waiting period in relation to the claim before the beginning of that period.

Note 1: For liquid assets see section 14A.

Note 2: For maximum reserve see section 14A.

Note 3: For served the waiting period in relation to a liquid assets test waiting period, see subsection 23(10A).

(2) The liquid assets test waiting period in relation to the claim is to be worked out under subsections (2A), (2B) and (2C).

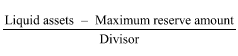

(2A) Work out the number of formula weeks (disregarding any fractions of a week) in relation to the claim using the formula:

where:

"liquid assets" means the person's liquid assets.

"maximum reserve amount" means the maximum reserve in relation to the person under subsection 14A(1).

"divisor" means, in relation to a person:

(a) if the person is not a member of a couple and does not have a dependent child--$500; or

(b) otherwise--$1,000.

(2B) If the number of formula weeks is equal to or greater than 13 weeks, the liquid assets test waiting period in relation to the claim is 13 weeks.

(2C) If subsection (2B) does not apply, the liquid assets test waiting period in relation to the claim is the number of weeks equal to the number of formula weeks.

(3) If the person is not a member of a couple, the liquid assets test waiting period in relation to the claim starts on:

(a) if subparagraph 593(1)(a)(ii) does not apply in relation to the person--subject to subsection (3AA), the day following the day on which the person ceased work or ceased to be enrolled in a full time course of education or of vocational training; or

(b) if subparagraph 593(1)(a)(ii) applies in relation to the person--subject to subsection (4), the day on which the person became incapacitated for work or study.

(3AA) If subparagraph 593(1)(a)(ii) does not apply in relation to the person and the person:

(a) is not a member of a couple; and

(b) is not required to satisfy the employment pathway plan requirements because of a determination that is in effect under section 40L of the Administration Act and that has been made because of the circumstance referred to in paragraph 40L(5)(a) of that Act;

the liquid assets test waiting period in relation to the claim starts on the day on which the person became incapacitated.

(3A) If the person is a member of a couple, the liquid assets test waiting period in relation to the claim starts on the last occurring of the following days:

(a) either:

(i) if subparagraph 593(1)(a)(ii) does not apply in relation to the person--subject to subsection (3B), the day following the day on which the person ceased work or ceased to be enrolled in a full time course of education or of vocational training; or

(ii) if subparagraph 593(1)(a)(ii) applies in relation to the person--subject to subsection (4), the day on which the person became incapacitated for work or study;

(b) if, when the claim is made, the person's partner has ceased work--the day following the day on which the person's partner ceased work;

(ba) if, when the claim is made, the person's partner has ceased to be enrolled in a full time course of education or of vocational training--the day following the day on which the person's partner so ceased;

(c) if, when the claim is made, the person's partner is incapacitated for work--the day on which the person's partner became incapacitated for work.

(3B) If subparagraph 593(1)(a)(ii) does not apply in relation to the person and the person:

(a) is a member of a couple; and

(b) is not required to satisfy the employment pathway plan requirements because of a determination that is in effect under section 40L of the Administration Act and that has been made because of the circumstance referred to in paragraph 40L(5)(a) of that Act;

the liquid assets test waiting period in relation to the claim starts on the last occurring of the following days:

(c) the day on which the person became incapacitated for work;

(d) if, when the claim is made, the person's partner has ceased work--the day following the day on which the person's partner ceased work;

(da) if, when the claim is made, the person's partner has ceased to be enrolled in a full time course of education or of vocational training--the day following the day on which the person's partner so ceased;

(e) if, when the claim is made, the person's partner is incapacitated for work--the day on which the person's partner became incapacitated for work.

(4) If:

(a) a person becomes qualified for austudy payment; and

(b) because of paragraph 575(2)(a), austudy payment is not payable to the person while the person is subject to a liquid assets test waiting period; and

(c) within the liquid assets test waiting period referred to in paragraph (b):

(i) the person becomes incapacitated for study; and

(ii) the person claims jobseeker payment; and

(d) subparagraph 593(1)(a)(ii) applies in relation to the person;

the liquid assets test waiting period in relation to the claim for jobseeker payment starts on the day on which the person becomes qualified for austudy payment.

(4A) Subsection (1) does not apply to a person if, at any time during the 12 months preceding:

(a) if subparagraph 593(1)(a)(ii) does not apply in relation to the person--the day following the day on which the person ceased work or ceased to be enrolled in a full time course of education or of vocational training; or

(aa) if subparagraph 593(1)(a)(ii) applies in relation to the person--the day on which the person becomes incapacitated for work or study; or

(b) in any case--the day on which the person claims a jobseeker payment;

the person or their partner was serving a liquid assets test waiting period that started during that 12 months.

(5) If the Secretary is satisfied that a person is in severe financial hardship because the person has incurred unavoidable or reasonable expenditure while serving a liquid assets test waiting period, the Secretary may determine that the person does not have to serve the whole, or any part, of the waiting period.

Note 1: For in severe financial hardship see subsection 19C(2) (person who is not a member of a couple) and 19C(3) (person who is a member of a couple).

Note 2: For unavoidable or reasonable expenditure see subsection 19C(4).

(6) Subsection (1) does not apply to a person who becomes qualified for jobseeker payment at the end of a continuous period in respect of which the person received income support payments (whether or not the kind of payment received has changed over the period and whether the period or any part of it occurred before or after the commencement of this subsection).

Note 1: For income support payment see subsection 23(1).

Note 2: For the determination of the continuous period in respect of which a person received income support payments see section 38B.

(8) Subsection (1) does not apply to a person who:

(a) is undertaking an activity specified in an instrument made under subsection (8A); and

(b) has been exempted from the application of subsection (1) by the Secretary.

(8A) The Secretary may, by legislative instrument, specify activities for the purpose of paragraph (8)(a).

(8B) Subsection (1) does not apply to a person if:

(a) the person makes a claim for jobseeker payment on or after the commencement of this subsection; and

(b) the person makes the claim after the death of the person's partner on or after the commencement of this subsection; and

(c) if the person is a man or a woman who was not pregnant when her partner died--the person makes the claim in the period of 14 weeks starting on the day of the death of the partner; and

(d) if the person is a woman who was pregnant when her partner died--the person makes the claim:

(i) in the period of 14 weeks starting on the day of the death of the partner; or

(ii) in the period starting on the day of the death of the partner and ending when the child is born or the woman otherwise stops being pregnant;

whichever ends later.

(9) A reference in this section to the day on which a person ceased work (whether the person ceases work permanently, temporarily or by reason of being on unpaid leave) is a reference:

(a) except where the person is on paid leave immediately after last performing work--to the day on which the person last performed work before so ceasing; and

(b) if the person is on paid leave--to the last day on which the person is on that paid leave.