Commonwealth Consolidated Regulations

Commonwealth Consolidated Regulations Commonwealth Consolidated Regulations

Commonwealth Consolidated RegulationsNote: See sections 291 - 170.02, 291 - 170.05 and 291 - 170.07 and Schedule 1AA.

1.1 Meaning of accruing member

An accruing member of a superannuation fund for a financial year is a defined benefit member of the fund who is not a non - accruing member of the fund for the financial year (within the meaning given by subsection 291 - 170.04(5)).

1.2 Meaning of benefit category

(1) A benefit category is a category of membership of a defined benefit fund as certified by an actuary.

(2) An actuary must not certify a category of membership to be a benefit category unless the actuary is satisfied that:

(a) each hypothetical new entrant to the benefit category with the same entry age would accrue retirement benefits on substantially the same basis; or

(b) if any 2 hypothetical new entrants to the benefit category accrued retirement benefits on a different basis, the new entrant rates for each member calculated under Parts 2 and 3 would be equal.

1.3 Meaning of defined benefit fund

A defined benefit fund is a superannuation fund in which a member has a defined benefit interest.

(1) An accruing member must not belong to more than one benefit category of the same defined benefit fund on the same day unless certified by an actuary.

(2) An actuary must not certify that a member belongs to more than one benefit category on the same day unless the actuary is satisfied that the amount of notional taxed contributions to be reported will not be materially different from the amount of notional taxed contributions that would have been reported had the member belonged to only one benefit category on each relevant day.

Note: An accruing member would be ordinarily expected to belong to only one benefit category at a time. However, there might be circumstances in certain funds where it is materially more practical for the purpose of calculating the total amount of notional taxable contributions to deem that some members belong to more than one benefit category from time to time.

That part of a defined benefit interest which is sourced from contributions made into a superannuation fund or earnings on such contributions is referred to as the fund benefit .

Note: A superannuation benefit may be wholly sourced from contributions made into a superannuation fund or earnings on such contributions. A superannuation benefit paid from a public sector superannuation fund may be wholly or partly sourced, or not sourced to any extent, from contributions made into a superannuation fund or earnings on such contributions. If a superannuation benefit is not sourced to any extent from contributions made into a superannuation fund, or earnings on such contributions, the amount of the fund benefit is zero.

If the fund benefit in relation to a benefit category is wholly sourced from:

(a) an accumulation of concessional contributions made to a superannuation fund in respect of a member or earnings on such contributions; or

(b) an accumulation of member contributions or earnings on such contributions;

the amount of NTC for the purposes of clause 1.8 for an accruing member of the benefit category for a financial year is the amount of concessional contributions made to the superannuation fund in respect of the member during the financial year.

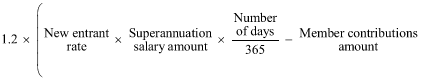

If clause 1.6 does not apply, the method of working out the amount of NTC for the purposes of clause 1.8 for an accruing member of a benefit category of a defined benefit fund for a financial year is the following formula:

where, for the financial year:

"member contributions amount" is the amount of member contributions:

(a) paid by or on behalf of the member in respect of the member's defined benefit interest in the fund during that part of the financial year that the member was an accruing member of the benefit category; and

(b) which are not assessable income of the fund.

"new entrant rate" is the new entrant rate for the benefit category worked out by an actuary under Parts 2 and 3.

"number of days" is the number of days during the financial year that the member was an accruing member of the benefit category.

"superannuation salary amount" is the member's annual superannuation salary relevant to the benefit category on the first day of the financial year on which the member had a defined benefit interest in the fund.

1.8 Method of working out amount of notional taxed contributions

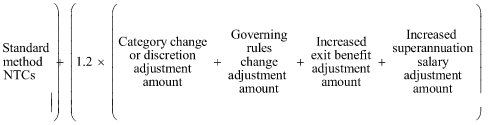

The method of working out the notional taxed contributions for an accruing member of a defined benefit fund for a financial year is the following formula:

where, for the financial year:

"category change or discretion adjustment amount" is an amount worked out on advice from an actuary under Part 5.

"governing rules change adjustment amount" is an amount worked out on advice from an actuary under Part 6.

"increased exit benefit adjustment amount" is an amount worked out on advice from an actuary under Part 4.

"increased superannuation salary adjustment amount" is an amount worked out on advice from an actuary under Part 7.

"standard method NTCs" is the sum of the amounts of NTC for each benefit category that the member belongs to during the financial year calculated under clauses 1.6 and 1.7.

2.1 Method of working out new entrant rate for a benefit category

(1) The new entrant rate for a benefit category is the rate calculated under this Part and using the assumptions set out in Part 3.

(2) The new entrant rate for a benefit category is the rate that represents the long - term cost, expressed as a percentage of superannuation salary, of providing as much of the fund benefit as is payable on a voluntary exit to a hypothetical new entrant to the benefit category.

(3) The new entrant rate is calculated as the present value of the fund benefit payable on voluntary exit (resignation, early retirement, or retirement) under the rules of the defined benefit fund which are applicable to a new entrant to the benefit category divided by the present value of future superannuation salaries payable to the new entrant.

(4) To avoid doubt, the new entrant rate is to be calculated assuming that the fund benefit is to be wholly sourced from concessional contributions made into the fund at the new entrant rate and earnings on those contributions.

(5) The present value of the fund benefit is to be calculated having regard to the rules and practice of the defined benefit fund including benefit structure, caps, member options, reasonably expected discretions and member contributions, and using the economic, decrement and other parameters and the other assumptions set out in Part 3.

2.2 New entrant rate to be based on period of membership needed to reach maximum benefit accrual

If the rules of the defined benefit fund applicable to the benefit category provide for a maximum benefit accrual, the new entrant rate is to be calculated on the basis that the benefit is funded over the period to when maximum accrual is attained.

Note: This means that, for the purpose of calculating the present value of future salaries payable to the new entrant, the superannuation salary is to be assumed to be zero at those ages after reaching maximum benefit accrual.

Example : If maximum accrual is attained after 20 years of membership, the superannuation salary for a 30 - year - old new entrant will be assumed to be zero at age 50 and above for the purpose of calculating the present value of future salaries payable to the new entrant.

2.3 New entrant rate to be rounded down

The new entrant rate is to be rounded down to the lower 1 percentage point.

Example : 10.6% would be rounded down to 10%.

2.4 No allowance for administration expenses or income tax on assessable contributions

The new entrant rate is to be calculated ignoring:

(a) administration expenses; and

(b) income tax on assessable contributions.

Note: These items are allowed for in the formula in clause 1.7 by multiplying by 1.2.

2.5 Certain discretions to be allowed for

(1) The new entrant rate is to be calculated assuming that certain discretions are always exercised.

(2) Subject to subclause (3), if the fund rules provide a discretion to pay, on voluntary exit, a benefit that is higher than the standard benefit, the actuary must assume that a higher benefit is always paid on voluntary exit on or after age 55.

(3) If the higher benefit mentioned in subclause (2) exceeds the accrued retirement benefit, the actuary may assume that the benefit is an amount:

(a) greater than or equal to the accrued retirement benefit; and

(b) less than or equal to the higher benefit.

(4) If the actuary believes that there is a reasonable expectation that a higher benefit than either the standard benefit or the accrued retirement benefit will be paid, then the actuary should assume that the benefit paid on voluntary exit on or after age 55 is always equal to the benefit reasonably expected to be paid.

Note: In considering whether there is a reasonable expectation that a higher benefit will be paid, it would generally not be appropriate to assume payment unless such an assumption was adopted in the most recent actuarial review.

2.6 Method of working out new entrant rate for a member

(1) If a member belongs to exactly one benefit category at a particular time, the new entrant rate for the member at that time is the new entrant rate for that benefit category.

(2) If a member belongs to more than one benefit category at a particular time, the new entrant rate for the member at that time is the sum of the new entrant rates for each benefit category to which the member belongs.

Note: The new entrant rate for a member is relevant to sections 291 - 170.05 and 291 - 170.07.

Part 3 -- Valuation parameters

3.1 Application of economic, decrement and other parameters

For the purpose of working out the new entrant rate for a benefit category mentioned in Part 1 or 2, the actuary is to apply the economic, decrement and other parameters set out in this Part.

(1) The discount rate to be used to discount projected future benefits and salaries is 8% per year.

(2) The discount rate is not to be adjusted for investment expenses or investment - related taxation or for any other reason.

3.3 Fund earning rate and crediting rate

(1) If necessary, the fund earning rate to be assumed is 8% per year.

(2) If necessary, the assumed crediting rate is to be based on the assumed fund earning rate.

3.4 Rate of future salary or wages growth

(1) The rate of salary or wages growth to be applied is 4.5% per year.

(2) This rate is to be used:

(a) to project the value of future salary or wages; and

(b) to project benefits that increase in accordance with a general wage index (for example, average weekly earnings).

3.5 Rate of increase in price indices

If a benefit is linked to an increase in a price index (for example, the Consumer Price Index), the rate of increase in the price index to be applied is 2.5% per year.

(1) The age of new entrants to be assumed is based on the average age of entry to the fund of the persons who were defined benefit members of the fund at 1 July 2007.

(2) The following table sets out the age of new entrants that is to be assumed.

New entrant age | ||

Item | Average age last birthday at commencement in fund of defined benefit members of the fund at 1 July 2007 | New entrant age to be assumed |

1 | <30 | 25 |

2 | 30 - 34 | 30 |

3 | 35 - 39 | 35 |

4 | 40 - 44 | 40 |

5 | 45 - 49 | 45 |

6 | 50+ | 50 |

(3) If:

(a) there has been a transfer of defined benefit members from a predecessor fund into the fund, or a superannuation sub - fund of the fund; and

(b) the actuary considers it reasonable to do so;

the actuary may determine a new entrant age for the fund or superannuation sub - fund taking account of the average age of entry used for or relevant for those members in the predecessor fund.

(4) For the purposes of this clause, a defined benefit member does not include a person who:

(a) is receiving only a pension benefit from the fund; or

(b) has deferred the person's benefit entitlement in the fund.

(5) If the actuary believes that there is insufficient information available to calculate the average age of entry, the actuary is to assume that the age of a new entrant is 40.

(1) The following table sets out the rates of voluntary exit from the fund that are to be assumed.

Voluntary exit rates | ||

Item | Age band | Exit rate |

1 | <40 | 0.05 |

2 | 40 - 44 | 0.04 |

3 | 45 - 49 | 0.04 |

4 | 50 - 54 | 0.04 |

5 | 55 - 59 | 0.08 |

6 | 60 | 0.12 |

7 | 61 - 64 | 0.10 |

8 | 65 | 1.00 |

(2) The rate of involuntary exit (including by redundancy, death or invalidity) to be assumed is zero.

(1) If the fund benefit is a single life pension, the pension is to be valued using the assumptions set out in this Part.

(2) If the fund benefit is a reversionary pension, the value of the pension is to be taken as the value of the pension assuming it is a single life pension, increased by 10%.

The following table sets out the rates of pensioner mortality ( qx ) that are to be assumed.

Pensioner mortality ( qx ) rates | ||

Item | Age | qx |

1 | 35 - 49 | 0.003 |

2 | 50 - 54 | 0.004 |

3 | 55 | 0.005 |

4 | 56 | 0.006 |

5 | 57 | 0.006 |

6 | 58 | 0.007 |

7 | 59 | 0.008 |

8 | 60 | 0.008 |

9 | 61 | 0.009 |

10 | 62 | 0.010 |

11 | 63 | 0.012 |

12 | 64 | 0.013 |

13 | 65 | 0.014 |

14 | 66 | 0.016 |

15 | 67 | 0.017 |

16 | 68 | 0.019 |

17 | 69 | 0.021 |

18 | 70 | 0.023 |

19 | 71 | 0.026 |

20 | 72 | 0.029 |

21 | 73 | 0.032 |

22 | 74 | 0.035 |

23 | 75 | 0.039 |

24 | 76 | 0.043 |

25 | 77 | 0.048 |

26 | 78 | 0.053 |

27 | 79 | 0.059 |

28 | 80 | 0.064 |

29 | 81 | 0.070 |

30 | 82 | 0.077 |

31 | 83 | 0.085 |

32 | 84 | 0.095 |

33 | 85 | 0.106 |

34 | 86 | 0.116 |

35 | 87 | 0.128 |

36 | 88 | 0.139 |

37 | 89 | 0.149 |

38 | 90 | 0.159 |

39 | 91 | 0.168 |

40 | 92 | 0.176 |

41 | 93 | 0.184 |

42 | 94 | 0.193 |

43 | 95 | 0.202 |

44 | 96 | 0.211 |

45 | 97 | 0.219 |

46 | 98 | 0.228 |

47 | 99 | 0.236 |

48 | 100 | 1.000 |

3.10 Taxed and untaxed benefits

If the rules of the fund provide for benefits to be paid on either a taxed or an untaxed basis, the actuary is to assume that the employer component of the fund benefit is paid as a taxed benefit.

Note: This situation applies to a small number of funds where the employer component of the fund benefit is generally met by a last - minute contribution to the superannuation fund.

3.11 Other assumptions to be set by the actuary

(1) Any other assumptions which may be necessary are to be set by the actuary responsible for calculating the new entrant rate.

(2) The assumptions are to be based on the assumptions used in the most recent actuarial valuation of the fund, unless the actuary believes, having regard to the expected future experience of the fund, that they are no longer appropriate.

(3) If the actuary believes that the assumptions used in the most recent actuarial valuation are no longer appropriate, the assumptions should be set on a best estimate basis.

4.1 Method of working out the increased exit benefit adjustment amount in the formula in clause 1.8

For the purposes of the formula in clause 1.8:

(a) for a financial year in which the trustee of the defined benefit fund pays, as a result of an exercise of a discretion, a benefit to the member on:

(i) voluntary exit; or

(ii) redundancy that is not bona fide;

which exceeds the benefit assumed in calculating the new entrant rate for the benefit category to which the member belongs at the time the benefit is paid--the increased exit benefit adjustment amount equals an amount worked out on advice from an actuary that represents the amount of the excess; and

(b) for any other financial year--the increased exit benefit adjustment amount equals zero.

Note: If the trustee decides to pay an untaxed benefit rather than a taxed benefit, any excess of the amount of the untaxed benefit over the amount of the taxed benefit that would otherwise have been payable is not to be included in the increased exit benefit adjustment amount.

Part 5 -- Member has changed benefit category

(1) For the purposes of the formula in clause 1.8:

(a) for a financial year in which the member's accrued retirement benefit increases as a result of:

(i) a change of benefit category; or

(ii) an exercise of discretion;

the category change or discretion adjustment amount equals an amount worked out on advice from an actuary that represents the increase in the value of the accrued retirement benefit, if any, as a result of the change in benefit category or the exercise of the discretion; and

(b) for any other financial year--the category change or discretion adjustment amount equals zero.

(2) The economic, decrement and other parameters and the other assumptions to be used are set out in Part 3.

Part 6 -- Governing rules have changed

6.1 Method of working out governing rules change adjustment amount in the formula in clause 1.8

(1) For the purposes of the formula in clause 1.8:

(a) for a financial year in which there is an amendment of the governing rules (within the meaning of subsection 10(1) of the SIS Act) of the defined benefit fund that:

(i) may result in an increase in the member's benefit; and

(ii) is made for a reason other than to satisfy a legislative requirement;

the governing rules change adjustment amount equals an amount worked out on advice from an actuary that represents the increase in the value of the accrued retirement benefit, if any, that accrued to the member as a result of the amendment to the governing rules; and

(b) for any other financial year--the governing rules change adjustment amount equals zero.

(2) The economic, decrement and other parameters and the other assumptions to be used are set out in Part 3.

Part 7 -- Non - arm's length increase in superannuation salary

(1) For the purposes of the formula in clause 1.8:

(a) for a financial year in which the member's superannuation salary is increased in a non - arm's length way with the primary purpose of achieving an increase in superannuation benefit--the increased superannuation salary adjustment amount equals an amount worked out on advice from an actuary that represents the increase in the value of the accrued retirement benefit, if any, that accrued to the member as a result of the change in superannuation salary; and

(b) for any other financial year--the increased superannuation salary adjustment amount equals zero.

(2) The economic , decrement and other parameters and the other assumptions to be used are set out in Part 3.