Journal of Australian Taxation

|

Home

| Databases

| WorldLII

| Search

| Feedback

Journal of Australian Taxation |

|

TAX MORALE IN AUSTRALIA: WHAT SHAPES IT AND HAS IT CHANGED OVER TIME?

By Benno Torgler[*] and Kristina Murphy[**].

Why taxpayers pay their taxes voluntarily is an important question for tax administrations worldwide. Some believe it is because taxpayers are deterred from tax evasion out of a fear of being caught or penalized. Others, in contrast, suggest that factors such as the level of tax morale one has (ie, the intrinsic motivation one has to pay their tax) affects compliance behaviour. While there have been numerous empirical studies published that have explored the role of deterrence on tax compliance behaviour, very few studies have explored the concept of tax morale in any detail. This article therefore attempts to rectify this gap in the literature. If tax morale is important in determining compliance behaviour, as several researchers have suggested, then it is also important to understand what might affect one’s level of tax morale. The specific aim of this article will be to identify factors that shape or have an impact on tax morale. Using data collected from the Australian waves of the 1981 and 1995 World Values Survey, this study will demonstrate that factors such as trust and moral beliefs plan an important role in shaping tax morale in Australia. Further, it will be shown that tax morale has increased significantly in Australia since the early 1980s, and that it has done so at a faster rate than many other OECD countries. Possible explanations for this increase will be discussed.

Why do some people pay their taxes while others do not? This question has received increased attention in the tax compliance literature over the past few decades,[1] and a number of theories have been offered in an attempt to answer the question. For example, based on an expected utility argument, rational choice theorists have posited that people weigh up the costs and benefits of complying with the law and will disobey it if the anticipated penalties or probability of being caught are lower than the gains that could be experienced through non-compliance. In line with this economics-of-crime approach, Allingham and Sandmo presented a formal economic model showing that the extent of tax evasion was negatively correlated with the probability of detection and the degree of punishment.[2] Many economists have since taken Allingham and Sandmo’s findings to suggest that a deterrence policy should be used to “enforce” taxpayers to obey the law. In other words, they believe that harsh sanctions and penalties should be used to deter people from breaking the law.

The problem with the deterrence view, however, is that many empirical and experimental findings show that these deterrence models predict too little tax evasion.[3] In fact, in many countries the level of deterrence is too low to explain the high degree of tax compliance.[4] Take, for example, the issue of tax compliance in Australia. The tax system in Australia is based largely on self-assessment and voluntary compliance by taxpayers. The probability of receiving an audit from the Australian Taxation Office (“ATO”) is low. The chance of being caught avoiding tax is also, on the balance of probabilities, unlikely, and if a taxpayer is caught, the culpability penalties are relatively minor when compared to the potential for economic gain. Yet it has been found that the majority of Australian taxpayers still comply with their obligations and pay their taxes with good will.[5]

Furthermore, international research has also shown that there is a large gap between the amount of risk aversion that is required to guarantee such high compliance rates and the actual reported degree of risk aversion in the community, which has been found to be much lower.[6] In addition, tax compliance experiments mostly report higher levels of income declaration than the expected utility model would predict.[7] Findings such as these suggest that there is more to tax compliance behaviour than the rational choice theorists would have us believe.

Some researchers have argued that tax morale – the intrinsic motivation one has to pay their tax – can help to explain the high degree of tax compliance observed in many countries.[8] Before

proceeding any further, it may first be of benefit to briefly discuss how tax morale has been defined in the past and how it might relate to other concepts such as taxpayer ethics. As indicated above, the most standard definition given in the tax morale literature is that tax morale is basically the intrinsic motivation one feels to pay their taxes. This appears to be as far as most researchers go in defining the concept. It appears from reading the tax morale literature, however, that tax morale is very closely linked to what some other authors refer to as tax ethics. As noted by Jackson and Milliron, concepts such as these are “nebulous concepts to define”.[9] If we are to accept that these two concepts are very closely related, Song and Yarborough define taxpayer ethics as “the norms of behaviour governing citizens as taxpayers in their relationship with the government”.[10] So in other words, tax morale can generally be understood to describe the moral principles or values individuals hold about paying their tax. This will be how tax morale is defined and used in this article.

If tax morale is thought to be an explanation for why tax compliance rates are so high, it would be of interest to analyse what may shape tax morale among taxpayers. Surprisingly, however, there is very little evidence available on this topic. Feld and Tyran, for example, argue:

All in all, too little is known about which motivations of citizens shape tax morale.[11]Similarly, Feld and Frey point out that:

Most studies treat “tax morale” as a black box without discussing or even considering how it might arise or how it might be maintained. It is usually perceived as being part of the meta-preferences of taxpayers and used as the residuum in the analysis capturing unknown influences to tax evasion. The more interesting question then is which factors shape the emergence and maintenance of tax morale.[12]

Thus, the analysis of tax morale as a variable of interest (ie, the dependent variable) is rather novel in the tax compliance literature.[13] If tax morale is important in determining compliance levels, then it is also important to understand what might affect one’s level of tax morale. One of the purposes of this article, therefore, is to identify factors that may have an impact on tax morale. It aims to do so in the Australian tax context.

Australia is a particularly interesting country to analyse because there have been a number of major changes that have occurred to its tax system over the past 20 years. The most notable examples have been the introduction of the self-assessment system in 1986 and the introduction of the Goods and Services Tax in 2000. Accompanying some of these changes has been an increase in the complexity of the tax legislation[14] and the slow movement away from command and control enforcement strategies used by the ATO to progressively more cooperative and customer focused strategies.[15] Whether major changes such as these have served to increase or decrease tax morale is the focus of this article.

The article analyses a cross-section of individuals throughout Australia using the World Values Survey data of 1981 and 1995. Working with two datasets collected at two different points in time allows us to observe trends over time and it also allows us to assess the robustness of our main variables. The findings from these data suggest that tax morale has in fact increased over time in Australia. Furthermore, it will be shown that variables such as trust have a positive effect on tax morale. Before considering these findings in detail, however, Section 2 of the article first aims to outline some of the earlier research into tax morale. Section 3 then provides some information about the World Values Survey, with attention being given to the main variables used in the analysis. Section 4 presents the empirical findings while Section 5 discusses why tax morale may have increased in Australia from 1981 to 1995 and Section 6 finishes with some concluding remarks.

When analysing Swiss tax culture more than 100 years ago, Georg von Schanz stressed the relevance of taking taxpayers as partners in the tax contract between the State and its citizens.[16] Sixty years later, German scholars associated with the “Cologne school of tax psychology” conducted surveys and tried to measure tax morale among taxpayers.[17] They tried to lay the bridge between economics and social psychology, emphasising that economic phenomena should not only be analysed from the traditional point of view. They saw tax morale as an important and integral attitude that was related to tax non-compliance. For example, Schmölders analysed tax morale among self-employed workers in Europe.[18] He found that self-employed taxpayers had lower levels of tax morale than taxpayers who worked for other people or organisations. Strümpel also analysed tax morale among European taxpayers.[19] He conducted an international comparative survey in Europe, which compared the tax systems between the various European countries, as well as the level of tax morale among each country’s taxpayers. In that study, Strümpel found that tax morale in Germany was comparatively low, whereas in England it was comparatively high. He went on to suggest that the major difference between the German and English tax systems at the time was that the German Government made use of coercive tax enforcement techniques, while the English system treated taxpayers with more respect and less control. Strümpel argued that the enforcement strategies used by the Germans served to alienate the public which went on to negatively influence their level of tax morale. He suggested that the English system, in contrast, helped to cultivate tax morale (although he did note that such a system might have offered easy opportunities for avoidance and evasion).

While a large amount of preliminary tax morale research was conducted during the 1950s and 1960s by the “Cologne school of tax psychology”, since that time the concept of tax morale has largely been neglected by tax researchers. A number of contemporary tax compliance scholars have mentioned the concept of tax morale in their papers or books,[20] but only a select few have examined tax morale in any detail.[21]

When assessing what factors affected tax morale among Latin American countries, Torgler found that trust in Government officials, trust in others obeying the law, and numerous demographic variables predicted citizens’ level of tax morale.[22] Torgler also found that the level of tax morale was associated with the degree of tax avoidance in each country. For all countries examined, tax avoidance levels and the size of the cash economy were lower among countries that had higher levels of tax morale.

In another article, Torgler discussed in more detail three key factors that he believed were important for understanding tax morale.[23] These were: (a) moral rules and sentiments (eg, norms, guilt, etc); (b) fairness; and (c) the relationship between the taxpayer and the Government. Even with Torgler’s work, however, recent empirical research into tax morale has been almost non-existent in the tax compliance literature. With the recent availability of new international datasets, the opportunity has therefore arisen for tax researchers to expand upon previous works, to further explore the issues and factors that may shape tax morale, and to examine the level of tax morale in many different countries around the world. As mentioned earlier, the present study uses data from the 1981 and 1995 World Values Survey to examine tax morale in Australia. Tax morale levels in Australia will be compared to those of 20 other OECD countries for the purpose of examining trends in tax morale over time. The article also attempts to explore what factors may shape tax morale in Australia. In doing so, it will be the first time that tax morale has been examined empirically in Australia.

The data used in the present study came from the 1981 and 1995 World Values Survey.[24] The World Values Survey is a worldwide investigation of socio-cultural and political change. These surveys have assessed the basic values and beliefs of people around the world and have been carried out in about 80 societies representing over 80% of the world’s population. The World Values Survey was first carried out in 1981-83, with subsequent surveys being carried out in 1990-91, 1995-96 and 1999-2001.[25] Data from these surveys are made publicly available for use by researchers interested in how views change with time (although it is made available some years after the data has first been collected). The World Values Surveys have produced evidence of gradual but pervasive changes in what people value, what their beliefs are, and what they want out of life. The findings suggest that these changes have an important impact on human behaviour and social life. For example, the surveys have pointed to the conclusion that intergenerational changes are taking place in basic values relating to politics, economic life, religion, gender roles, family norms and sexual norms.[26]

For researchers who conduct and administer the World Values Survey in their respective country, it is a requirement that they follow the methodological requirements of the World Values Association. For example, surveys in the World Values Survey set are generally based on national representative samples of at least 1000 individuals 18 years and over (although sometimes people under the age of 18 participate). The samples are required to be selected using probability random methods, and the questions contained within the surveys generally do not deviate far from the original official questionnaire.[27] In the original 1981 wave of the Australian survey, a total of 1228 Australian citizens agreed to participate in the study. This was followed by a total of 2048 Australians agreeing to participate in the 1995 survey.

Using data from both the 1981 and 1995 Australian World Values Surveys, our main models for predicting tax morale in Australia have the following structure:[28]

TMi = β0 + β1 · ti + β2 · yi + β3 · RELi + β4 · TRi + β5 · CTLi + εi

where TMi denotes the individual degree of tax morale;

ti denotes a person’s tax rate;

yi denotes a person’s income;

TRi denotes trust in authority;

RELi denotes religiosity; and

CTLi denotes numerous control variables such as age, gender, marital status, education and occupational status.

The dependent variable in the present study is TAX MORALE (TMi). The general question to assess level of tax morale from the World Values Survey – and for which has been used in several previous research studies – was:

Please tell me for each of the following statements whether you think it can always be justified, never be justified, or something in between:

Cheating on taxes if you have the chance (answers to be given on a ten point scale 1 = “never justifiable” to 10 = “always justifiable”).

Given very few respondents would circle the numbers 4-10 on the original scale, it was decided here that the TAX MORALE variable should be recoded. The resulting TAX MORALE[29] variable was developed by reversing and recoding the ten-point scale into a four-point scale (ie, 0 = “always justifiable” to 3 = “never justifiable”; original scores of 4-10 were recoded into 0 = “always justifiable”).[30]

As discussed above, Torgler suggested that there were a number of key factors that seemed to be important for understanding tax morale.[31] Two of these factors included the relationship taxpayers had with their Government (ie, whether they trusted them), and taxpayers’ moral rules and sentiments. As part of his later empirical research, Torgler confirmed that these concepts predicted levels of tax morale in Latin America.[32] In order to see whether these variables were important in understanding tax morale in Australia, three questions that most closely measured these concepts were chosen from the Australian World Values Survey and used as predictors of tax morale.

Two core variables were used to explore the relationship taxpayers had with authority (TRi). One of the variables was TRUST IN THE LEGAL SYSTEM. This variable was measured in the World Values Survey as follows:

Could you tell me how much confidence you have in the legal system: is it a great deal of confidence, quite a lot of confidence, not very much confidence or none at all? (1 = “none at all” to 4 = “a great deal”).

The other variable used to explore the relationship taxpayers had with authority was TRUST IN THE PARLIAMENT. This variable was measured in the World Values Survey as follows:

Could you tell me how much confidence you have in the Parliament: is it a great deal of confidence, quite a lot of confidence, not very much confidence or none at all? (1 = “none at all” to 4 = “a great deal”).

These two variables allow us to analyse trust at the constitutional level (eg, trust in the legal system), thereby focusing on how the relationship between the State and its citizens is established, and also allow us to analyse trust more closely at the current politico-economic level (eg, trust in the Parliament).

The relationship between taxpayers and the State can be seen as a relational contract or psychological contract, which involves strong emotional ties and loyalties. Such a psychological tax contract can be maintained by positive actions that are based on trust. If the State is seen to be acting in a trustworthy manner, taxpayers might be more willing to comply with their tax obligations. In fact, empirical evidence collected in the tax arena appears to support this claim. For example, Scholz and Lubell found that if American taxpayers trusted government or other citizens they were more likely to comply with their tax obligations than taxpayers who did not trust.[33] Likewise, using survey data collected from Australian taxpayers involved in a long-standing dispute with the ATO, Murphy found that if taxpayers did not trust the ATO they were more likely to resist complying with their rules and decisions.[34] These findings seem to indicate that trust is an important institution, which influences citizens’ incentives to commit themselves to obedience. If this is indeed the case, one would therefore expect that those who have more trust in the legal system or in Parliament might also have higher levels of tax morale.

RELIGIOSITY (RELi) was an additional independent variable that was analysed in this study. In his earlier research into tax morale, Torgler argued that moral sentiments were important for understanding tax morale.[35] There are many behavioural norms and moral constraints that are strongly influenced by religious motivations. Previous empirical studies published in the criminology literature, for example, have shown that states and countries with higher rates of religious membership have significantly lower violent and non-violent crime.[36] Thus, it might also be the case that religious beliefs might influence people’s habits in the area of white-collar crime. For example, religion might be found to be a restriction

to engaging in tax evasion. Based on this assertion, it is therefore hypothesized that Australians who think of themselves as religious might be more likely to have higher levels of tax morale than those who do not consider themselves to be religious. In order to measure religiosity in the present study, the following question was taken from the World Values Survey:[37]

• Independently of whether you go to church or not, would you say you are:

1. A convinced atheist.

2. Not a religious person.

3. A religious person.

Earlier research into tax morale has also shown that a person’s economic situation can affect their level of tax morale. Two proxies of a person’s economic situation – TAX RATE (ti) and INCOME (yi) – were therefore used as predictors of tax morale in the present analysis. The effects of tax rate and income level on tax evasion are difficult to assess theoretically, and often the findings have been mixed.[38] The findings have also been found to depend on an individual’s risk preference and the progression of the income tax schedule.[39] A higher marginal tax rate makes tax evasion somewhat more profitable, but a contrary effect works depending on the risk aversion of taxpayers. Tax evasion has also been found to be influenced by the type of tax schedule adopted by an administration (ie, whether it is proportional, progressive, or regressive).[40]

The 1995 World Values Survey data also allowed us to use another proxy for a person’s economic situation. An additional question in the 1995 survey asked participants where they classified themselves in relation to SOCIAL CLASS (ie, lower class, working class, lower middle class, upper middle class and upper class).

In addition to the main independent variables discussed above (ie “trust variables”, “religiosity”, and “economic situation” variables), a number of additional independent variables were also used as controls (CTLi) to more fully explore what factors might shape tax morale. Each of these is listed below:

AGE: Tittle argues that older people are more sensitive to the threat of sanctions (both social and financial) and research has consistently found that older taxpayers are more compliant.[41] It has been suggested that this is because over the years older people have acquired more material goods, have obtained greater status in their community, and have a stronger dependency on the reactions from others.[42] Hence, the potential costs of sanctions increase for this group. Whether this sensitivity to sanction threat among older taxpayers also affects level of tax morale is tested here. Instead of using age as a continuous variable, four age categories were formed: 16-29, 30-49, 50-64, 65+, with the 16-29 age group being the reference group.

GENDER: Do women have different levels of tax morale than men? Social psychological research suggests that women are more compliant and less self-reliant than men,[43] although Peggy Hite did find that this was moderated by the educational level attained by the women.[44] Based on this past research, we would therefore expect that women should also have higher levels of tax morale than men.

MARITAL STATUS: Marital status might influence legal or illegal behaviour depending on the extent to which individuals are constrained by their social networks.[45] It has been argued by some that married people are more compliant than others because they are more constrained. Thus, we would predict that individuals with stronger social networks (eg, such as married people) would have higher tax morale than singles.

EDUCATION: The effect of education on tax morale is not clear at all. It could be reasonably assumed that educated taxpayers are more likely to know more about tax law and fiscal connections than uneducated taxpayers, and as a result are better aware of the benefits and services the State provides for citizens. But this assumption cannot be automatically accepted. If it were to be true, however, one might expect that educated taxpayers would be more compliant with their tax obligations.[46] On the other hand, educated taxpayers may be less compliant because they better understand opportunities for evasion and avoidance and might be more critical about and better aware of how the State uses tax revenues. In research conducted in the United States, Hite examined the relationship between education and tolerance of evasion.[47] She found that females with high levels of education were more tolerant of tax evasion than less educated women, whereas men were less tolerant of tax evasion as their education increased. Thus far there has been almost no research conducted that examines the effect of education on a taxpayer’s level of tax morale.

OCCUPATION STATUS: Does occupational status influence tax morale? The standard argument is that self-employed taxpayers evade more taxes. Lewis argues that self-employed persons have higher compliance costs so taxes therefore become more visible to them.[48] Furthermore, tax evasion might depend on the opportunity to evade or avoid taxes. Those taxpayers who are self-employed would have more opportunity to evade their taxes than taxpayers who have their taxes deducted each payday by their employers. In a European study conducted by Schmölders, it was found that self-employed taxpayers had lower levels of tax morale than taxpayers who worked for other people or organisations.[49] From this, we would therefore predict that self-employed Australians would have a lower level of tax morale than those employed by others. It should be noted, however, that the 1981 World Values Survey data did not contain a question that assessed self-employment status, so differences between self-employed workers and others could not be assessed. To test the hypothesis that self-employed Australians have lower levels of tax morale, we therefore had to rely on the 1995 data.

Additional variables could have been taken from the World Values Survey and included in the present analysis. However, one of the aims of this article was to provide a partial replication of previous research into tax morale.[50] As a result, the tested variables have been limited to those discussed above.

In all estimations presented here, the determinants of tax morale are analysed with ordered probit models. Ordered probit analysis was chosen because ordered probit models help to analyse the ranking information of the scaled dependent variable tax morale.[51] It should also be noted that as equations have a nonlinear form in ordered probit estimation, only the sign of the coefficient can be directly interpreted and not its size. Calculating the marginal effects for each coefficient is therefore a method that can be used to find the quantitative effect a variable has on tax morale. Marginal effects indicate the change in the share of taxpayers (or the probability of) belonging to a specific tax morale level, when the independent variable increases by one unit.

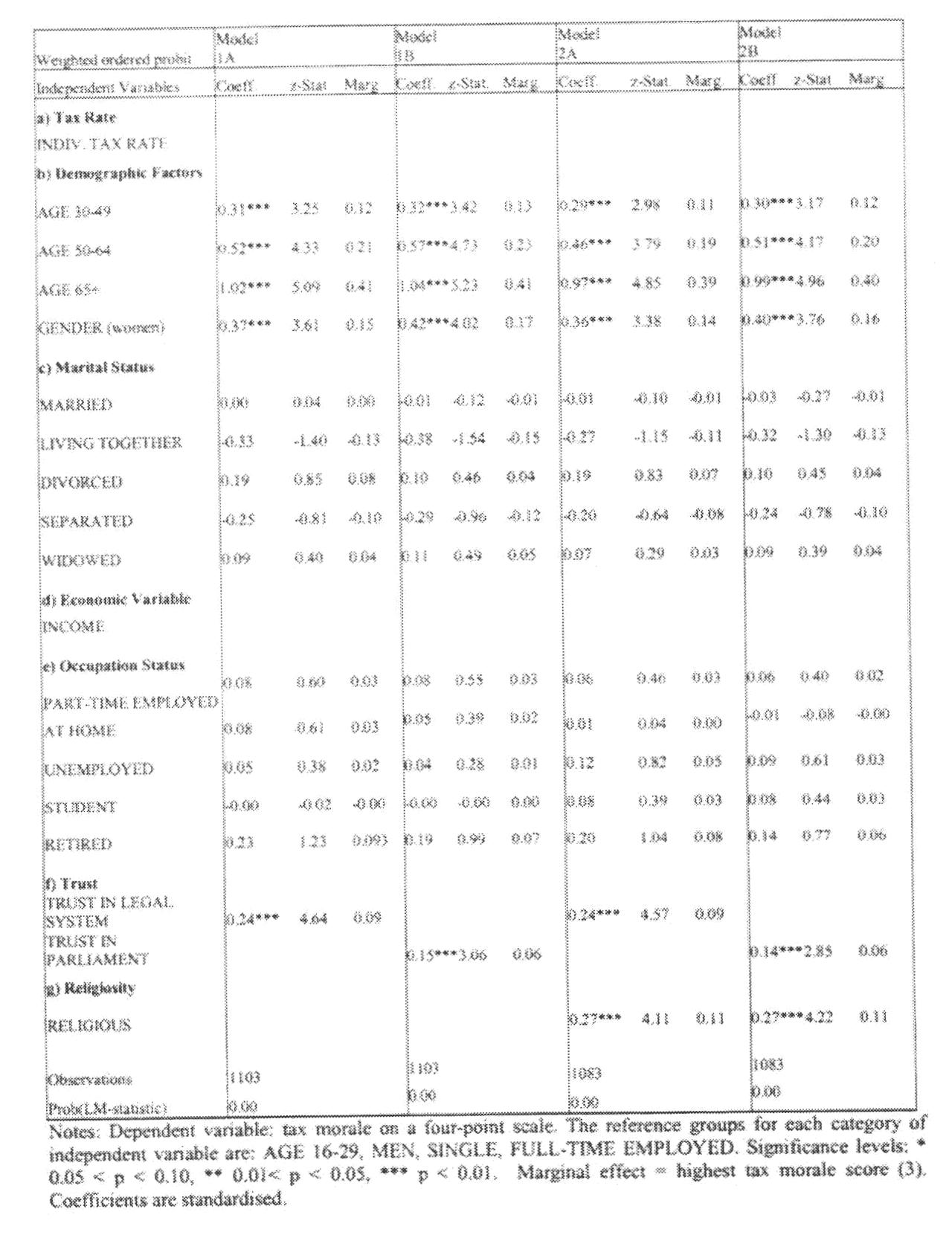

Further, in order to check the reliability and robustness of the independent variables used, we also chose to estimate a variety of models in our analysis (see Tables 1a, 1b, 2a, 2b, 3a and 3b). This was done by varying the variables that were entered into each model. In some models, some of the independent variables were included, and in others they were excluded. Even with these variations, however, it will be seen that the same findings and conclusions can be drawn across all models.

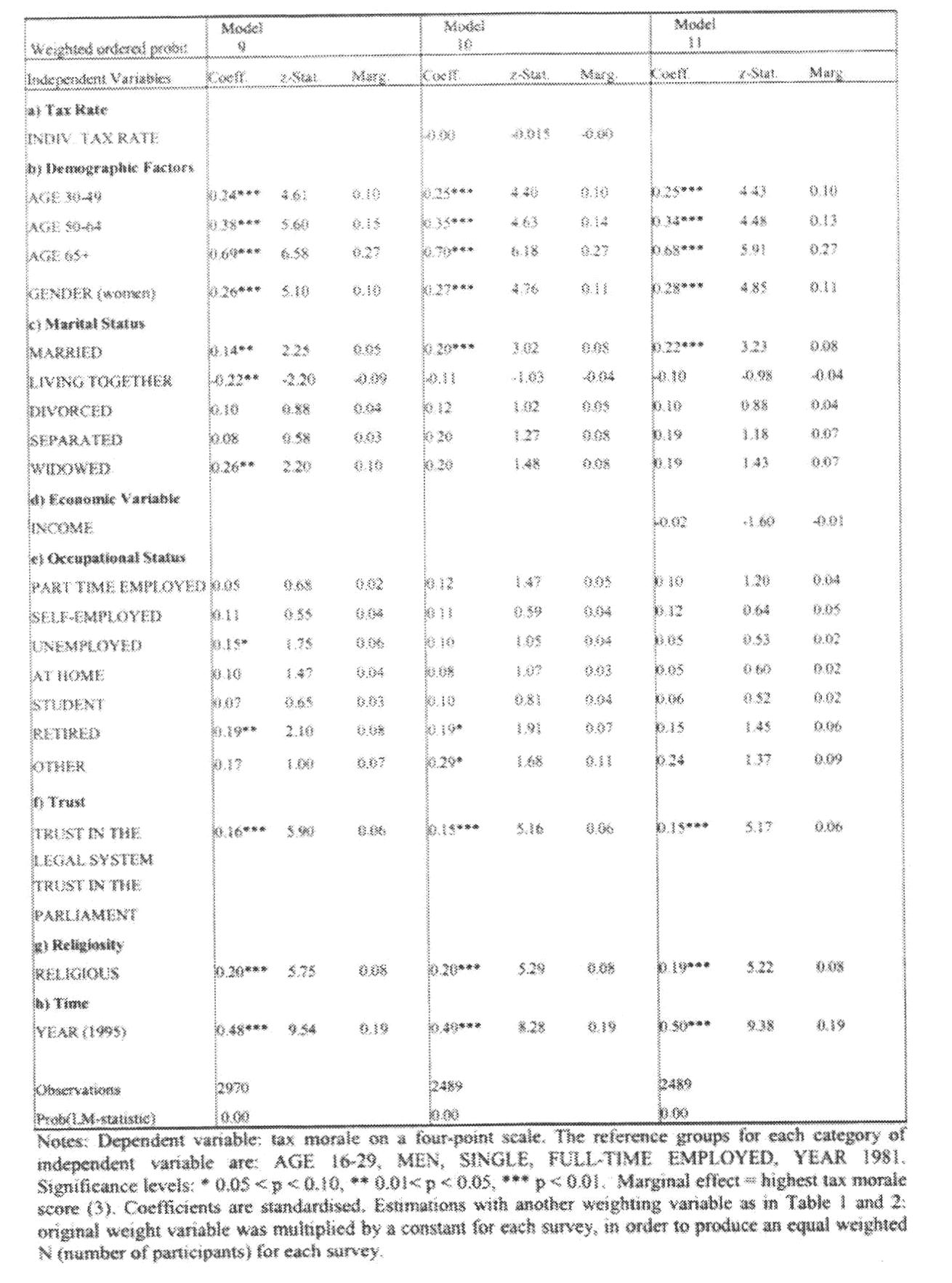

So what effect do our independent variables of choice have on Australia’s level of tax morale? We first present the empirical evidence for the 1981 data. Tables la and lb indicate that trust in the legal system has a positive impact on tax morale. An increase in the “trust in the legal system” scale by one unit raises the share of individuals stating that tax evasion is never justifiable by more than nine percentage points (see marginal effects). Further, in all models tested, trust in the Parliament can also be seen to have a positive impact on tax morale. An increase in the “trust in the Parliament” scale by one unit raised the share of individuals stating that tax evasion is never justifiable by more than six percentage points.[52] So in other words, we observe a reliable and significant relationship between trust and tax morale. The implication of these findings in particular, is that governments and regulators may find it worthwhile to nurture trust among those they regulate.[53] By doing so, they will be able to develop stronger relationships with those they regulate. As the results of the present study demonstrate, if there are higher levels of trust in authority then tax morale benefits positively.

It was also found that the more religious one is the higher their level of tax morale (see the high marginal effects between 11 and 12 percentage points for each level of religiosity). This finding therefore supports the claim made earlier that religiosity does affect tax morale in a positive way. Looking at the effect of a person’s economic situation on tax morale we can see that individual tax rates have a negative effect on tax morale – those who are subjected to higher tax rates have lower levels of tax morale – although this effect was not statistically significant. Similarly, income level is negatively correlated with tax morale – those earning more income have lower levels of tax morale. Again, however, this effect was not statistically significant.

It can also be seen from Tables 1a and 1b that some of the demographic control variables have an effect on tax morale. In all models tested, age has a positive impact on tax morale. All age groups from 30 to 65+ have significantly higher tax morale than the 16-29 year old reference group. For example, the proportion of people of the age 30-49 who report the highest level of tax morale (ie, that have a maximum score of 3) is around 12 percentage points higher than for the 16-29 reference age group. In fact, we can see that the marginal effects increase with an increase in age; the 65+ age group, for example, reports the highest tax morale of all age groups (see marginal effects). Tables 1a and 1b also show that being a woman rather than a man increases the probability of a person stating that tax evasion is never justified by more than 14 percentage points. Hence, Australian women have significantly higher levels of tax morale than Australian men. These findings support those obtained by Hite.[54] No significant effects were found for either the marital or employment status variables in any of the eight models tested.

Table 1a: Ordered Probit Analysis Showing Predictors of Tax Morale in Australia in 1981

Table 1b: Ordered Probit Analysis Showing Predictors of Tax Morale in Australia in 1981 Cont’d

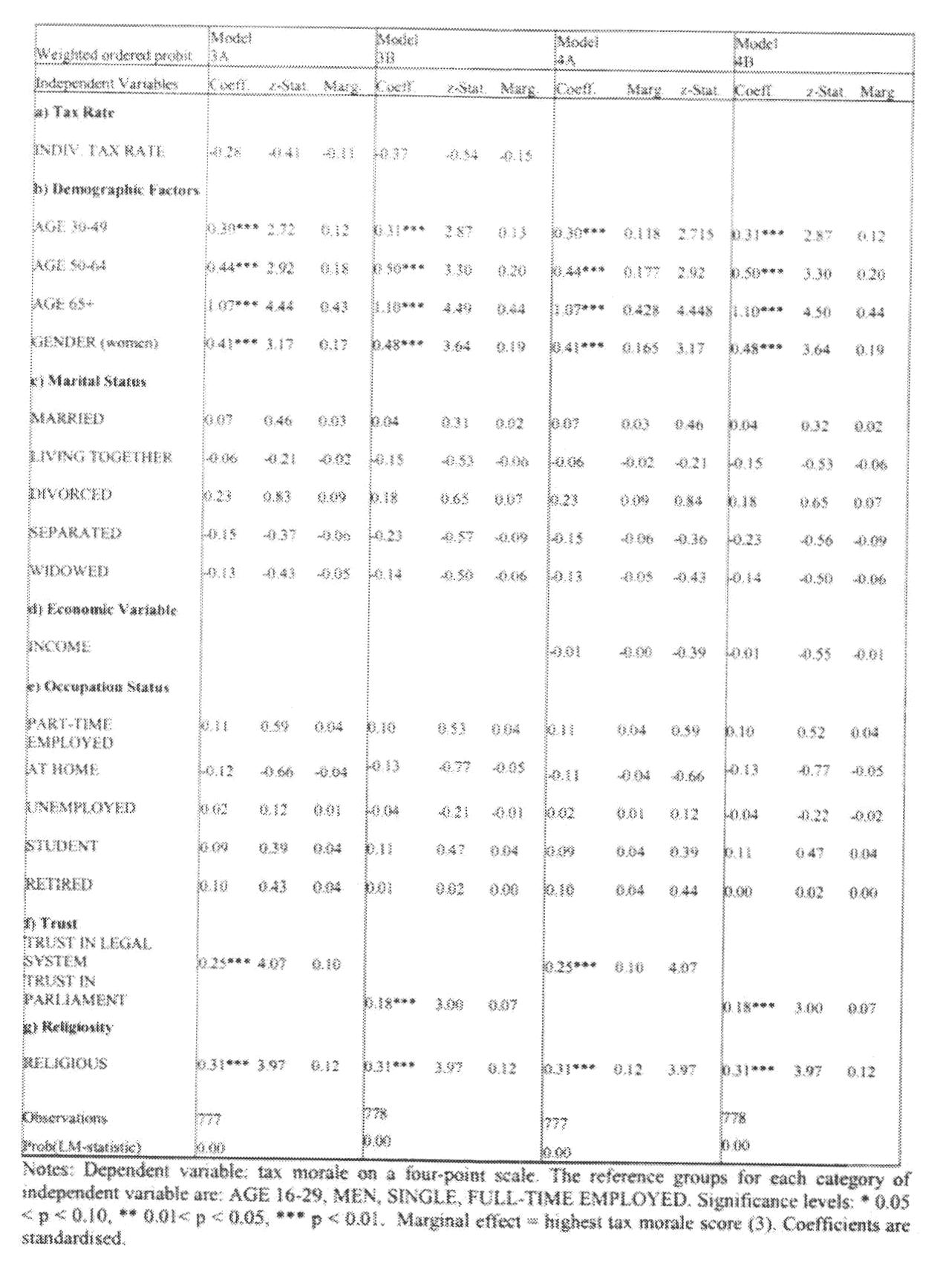

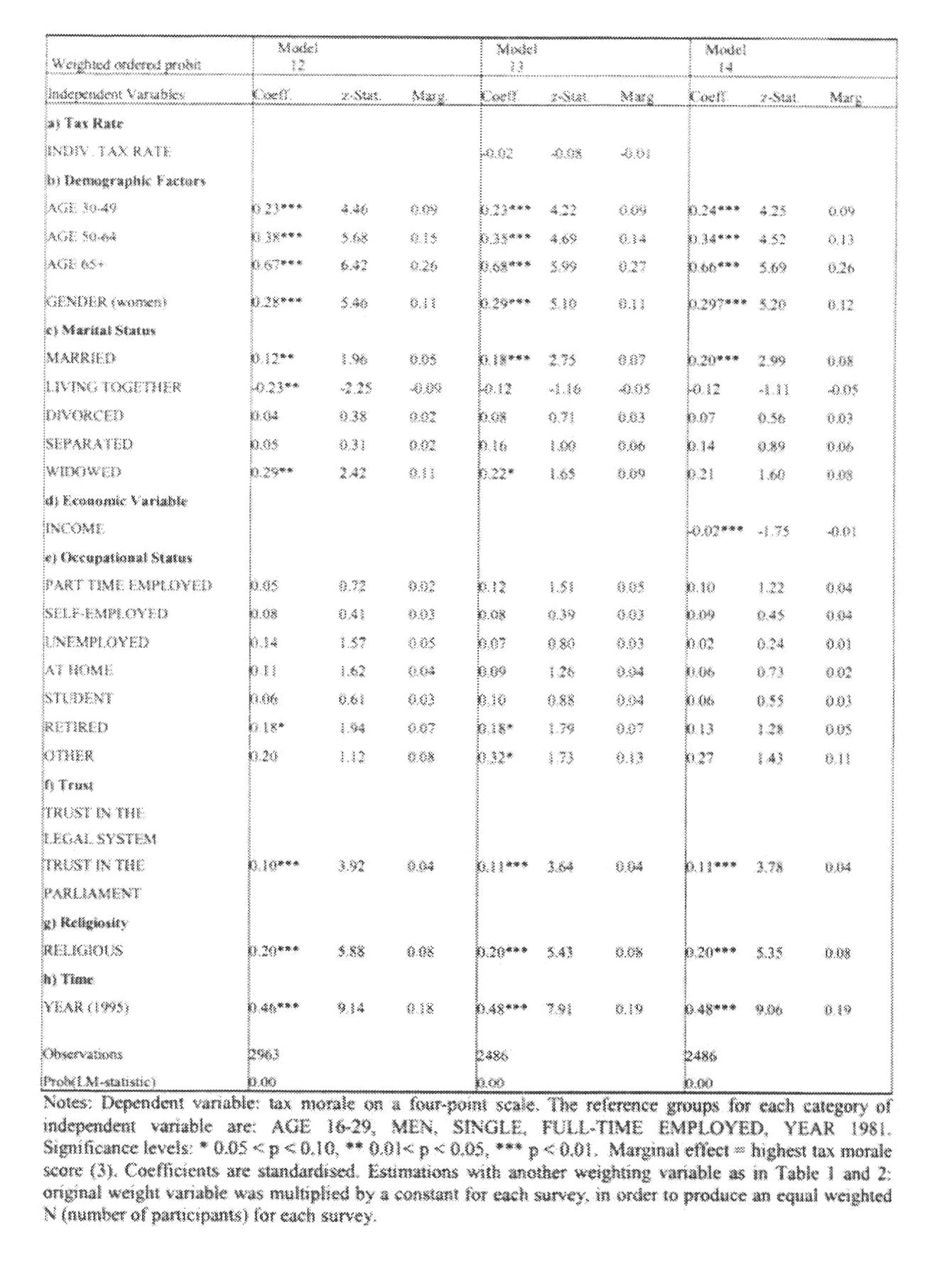

Tables 2a and 2b present the findings for the 1995 World Values Survey data. The 1995 data allowed us to incorporate some additional variables into the analysis (eg, ECONOMIC CLASS and EDUCATION). As can be seen in Tables 2a and 2b, the findings very closely mirror those of 1981, indicating that some predictors of tax morale might be stable over time. For example, higher trust in the legal system and higher trust in the Parliament in 1981 corresponded to higher levels of tax morale. This was also the case for the 1995 data. Similarly, those who indicated they were more religious also had higher levels of tax morale in 1995. It can also be seen from Tables 2a and 2b that an individual’s tax rates are negatively related to tax morale (ie, those who were subjected to higher tax rates tended to have lower tax morale). The relationship, however, was not significant. Again, this finding is similar to the 1981 data.

When analysing the economic situation variables, it can also be seen that the “income” variable has a negative effect on tax morale, although this variable was not found to be significant. Those who considered themselves to be of low economic status (ie, the reference group) were also found to have the lowest level of tax morale when compared to other class groups (this finding is indicated by the positive coefficients for the higher economic class groups). This variable, however, was not found to be a reliable predictor of tax morale.

When considering the effects of the control variables, like in the 1981 data there is a tendency for age to have a positive impact on tax morale – older Australians have higher tax morale. However, the coefficients in Models 7 and 8 of Table 2b show that the positive effects of age diminish when the variables TAX RATE or INCOME are included the analysis. Like in the 1981 data, women also report higher levels of tax morale than men.

Table 2a: Ordered Probit Analysis Showing Predictors of Tax Morale in 1995

Table 2b: Ordered Probit Analysis Showing Predictors of Tax Morale in 1995 Cont’d

Unlike in the 1981 data, marital status appears to have an effect on tax morale in 1995. Compared to single people, those who are married have significantly higher levels of tax morale, thus supporting one of our hypotheses. It was also found that widowed and separated Australians had significantly higher levels of tax morale than single Australians. When considering employment status in 1995, retired people and those keeping house appeared to show significantly higher levels of tax morale. Unlike in previous international research, there was no effect of self-employment status in the present study. Finally, there was no effect of education on tax morale.

Thus far, we have discussed the findings of the Australian wave of the 1981 and 1995 World Values Survey independently. We have found that many of the variables that have been found to predict and shape tax morale among Europeans and Latin Americans[55] have also been found to predict and shape tax morale among Australians. For example, like in the international research, trust in Government institutions (eg, Parliament, legal system) has been found to predict tax morale levels in Australia. A person’s moral beliefs have also been shown to predict tax morale. Finally, a number of demographic variables were found to predict tax morale among Australians.

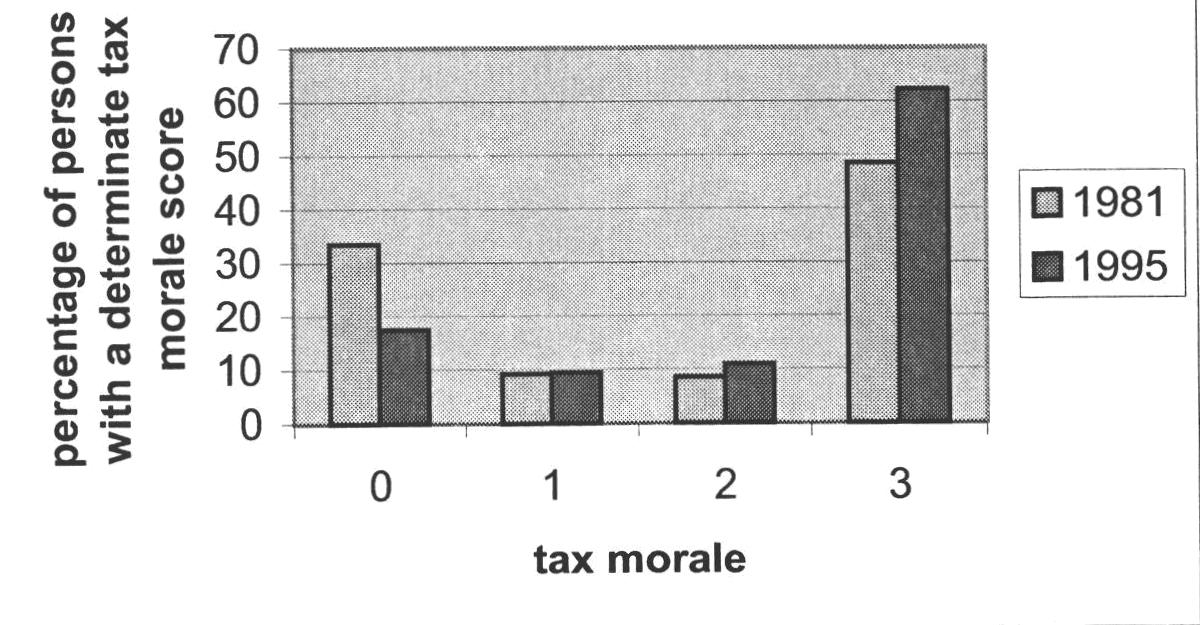

What we have not shown so far, however, is whether tax morale in Australia has changed substantially over time. Has tax morale increased between 1981 and 1995, or has it decreased over this time period? Figure 1 presents a histogram which details the distribution of tax morale scores in Australia for both 1981 and 1995. As discussed in the methodology section, those scoring higher on the tax morale scale have a higher intrinsic motivation to pay their taxes (ie, believe they should pay their taxes).

From Figure 1 it can be seen that there is a difference between the two time periods. Contrary to expectation, it appears that tax

morale in Australia has actually increased between 1981 and 1995. In 1995, 62% of the respondents thought that tax evasion was never justifiable, compared to 48% in 1981. Furthermore, when compared to responses in 1981, it can also be seen that fewer Australians in 1995 believed evading tax was always justifiable (from 34% in 1981 to 17% in 1995). These findings are promising as they suggest that Australians’ level of tax morale has in fact increased over the time period examined. The belief that people should pay their taxes appears to have become stronger in Australia since the early 1980s.

Figure 1: Distribution of Tax Morale Scores in Australia for Both the 1981 and 1995 World Values Survey

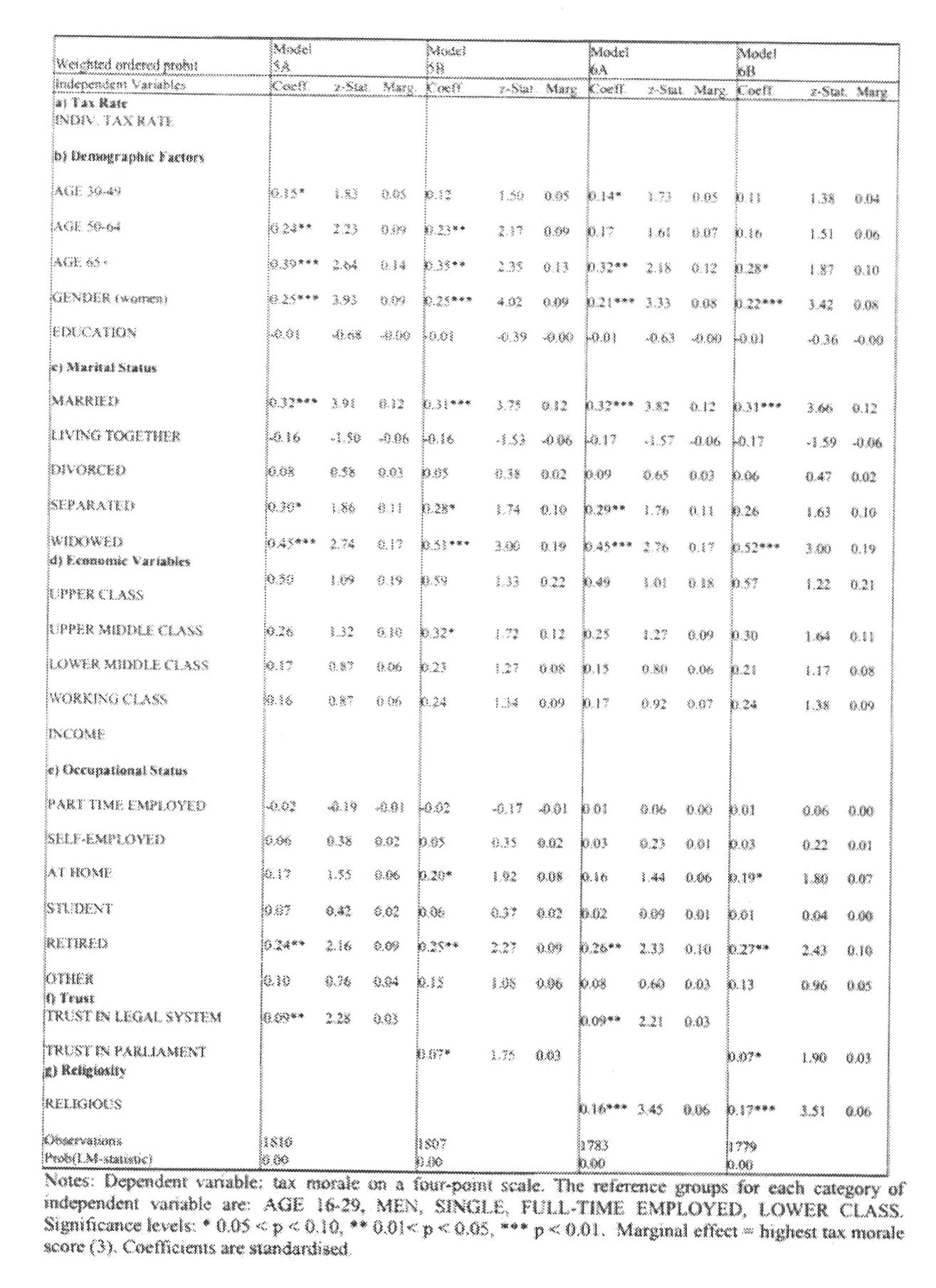

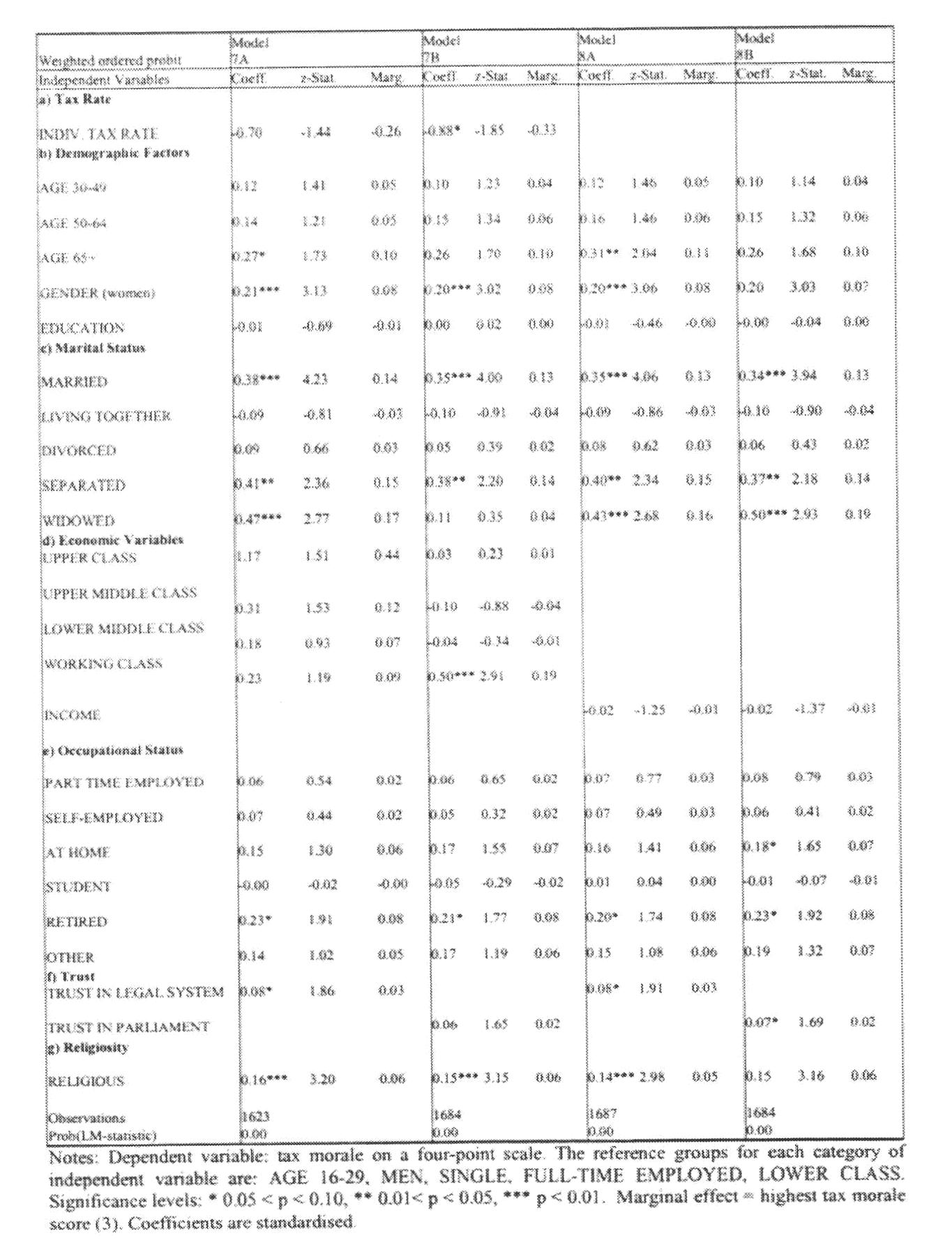

In order to assess whether the change in tax morale between 1981 and 1995 has been a significant change, statistical analyses were conducted on the data. An ordered probit analysis was again used, ensuring that a number of key variables were controlled for. A TIME dummy variable was created, with 1981 being the reference group in which to check for possible differences across time. In order to compensate for the fact that the number of participants in the 1995 data set was much larger than for the 1981 dataset, the observations were weighted to get an equal number of observations for each year.[56] The findings are presented in Tables 3a and 3b.

The main finding of interest, after controlling for numerous variables, is that tax morale in Australia was significantly higher in 1995 than in 1981. This can be seen by examining the regression coefficients for the TIME variable. Here it can be seen that TIME has a positive relationship with tax morale, indicating that in 1995, tax morale scores were higher than in 1981. In other words, tax morale in Australia appears to have increased significantly over time. The marginal effects are particularly high, showing values around 19 percentage points. All the variables that were found to predict tax morale in Tables 1a, 1b, 2a and 2b were also found to predict tax morale in Tables 3a and 3b. Possible explanations for why tax morale may have increased in Australia between 1981 and 1995 will be discussed in Section 5 below.

Table 3a: Ordered Probit Analysis Exploring Changes in Tax Morale Between 1981 and 1995

Table 3b: Ordered Probit Analysis Exploring Changes in Tax Morale Between 1981 and 1995 Cont’d

The analysis presented in the previous Section indicates that tax morale in Australia increased significantly between 1981 and 1995. The question that arises from such a finding is whether the observed increase in tax morale in Australia is a general international tendency.

So far only one study (apart from this one) has investigated how tax morale has changed across time in different countries.[57] Given that there are significant cultural differences, as well as governmental differences, between developed and developing countries,[58] it would be unwise to compare tax morale values among regions with a different economic and institutional level. For example, it could be the case that tax evasion might be considered justifiable by the majority of citizens in some developing countries, while we know this is not the case for Australia. Further, there might even be a moral duty for citizens in some developing countries not to pay their taxes.[59] Hence, for our purposes, it would be more appropriate to make comparisons with countries more similar to our own.

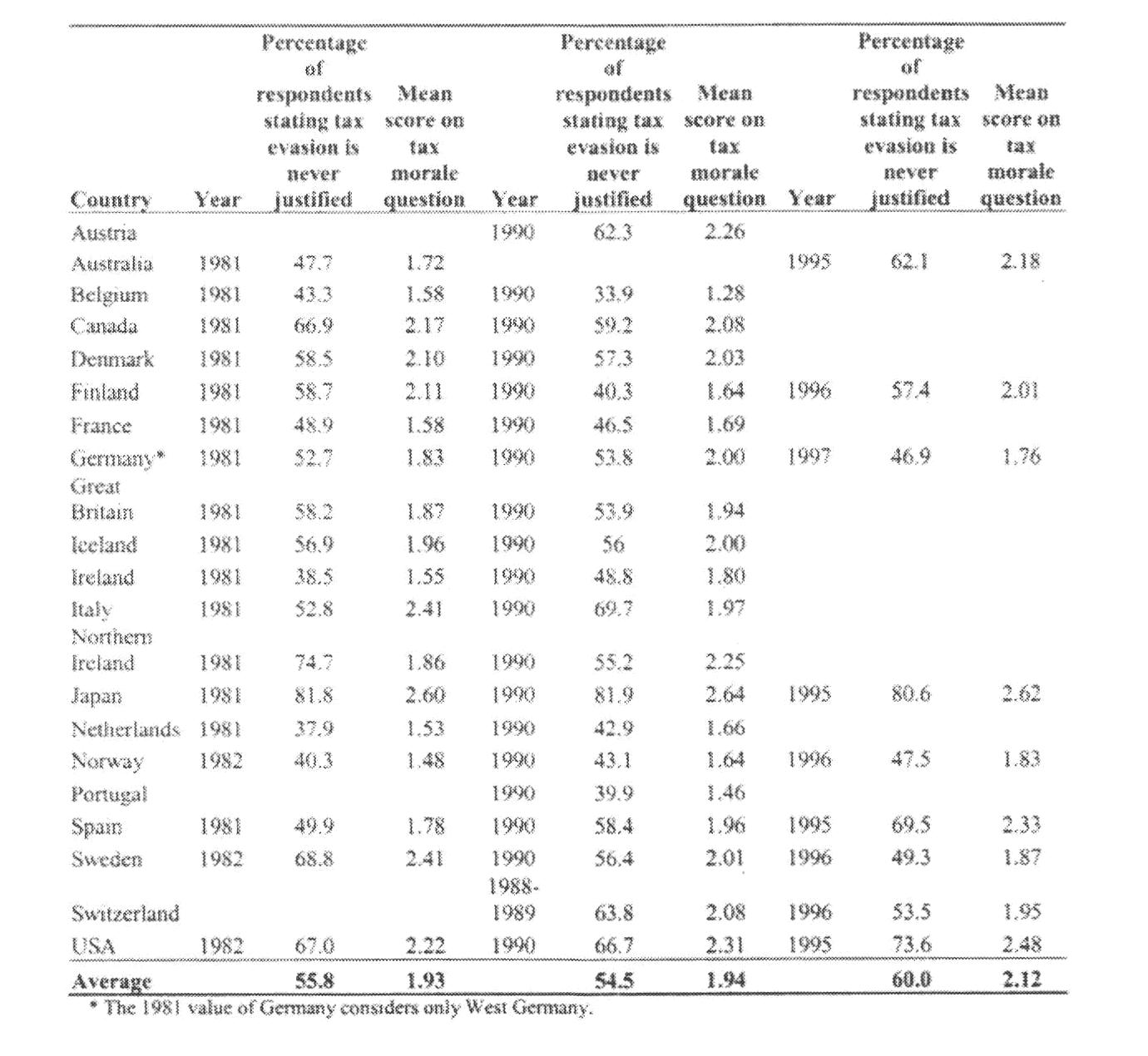

The aim of this Section, therefore, is to provide a comparison of Australia’s tax morale levels to those of 20 other OECD countries. It is important to do this for two reasons. First, from the findings presented so far it is unclear whether tax morale in Australia was substantially lower or higher in 1981 or 1995 than in any other OECD country. Second, the increase in tax morale in Australia between 1981 and 1995 may be unique to Australia and may not be shared by other developed countries. Table 4 presents a basic descriptive analysis showing the percentage of individuals in each OECD country saying that “tax evasion is never justifiable” (ie, those with the highest level of tax morale). Table 4 also presents the mean level of tax morale in Australia in relation to 20 other OECD countries.

Table 4: Tax Morale Levels Among OECD Countries as Assessed by the 1981, 1990 and 1995 World Values Surveys

First of all, it can be seen that in 1981 the average number of people among all OECD countries saying that tax evasion was never justified was 56%. This increased to 60% in 1995. Further the average score obtained for the tax morale question across all OECD countries was 1.93 (out of 3). This increased to 2.12 in 1995. While there have been some countries in the OECD who have had

decreases in tax morale over time (eg, Sweden and Germany), in general, it appears that tax morale among the OECD countries has increased slightly over time.[60]

When comparing the Australian figures to those of the rest of the OECD, it can be seen in Table 4 that Australia’s level of tax morale in 1981 (48%) was substantially below the OECD average (56%). However, in 1995 Australia’s level of tax morale (62%) was slightly above the OECD average (60%),[61] suggesting that tax morale in Australia changed substantially more than average than tax morale in other OECD countries (at least between 1981 and 1995). Possible explanations for why tax morale in Australia may have increased significantly over this time will be discussed in the following Section.

There could be any number of possible reasons that could be given to explain why tax morale may have increased in Australia between 1981 and 1995. While this fact is acknowledged here, only three possible explanations are offered below.

In her book on the history of Australian taxation, Julie Smith discussed how in the early 1980s, the Australian Government was facing numerous complaints about the existing income tax system.[62]

There was the perception among the public that many were not meeting their taxation obligations and it was clear that taxpayer compliance had eroded. “Tax evasion was also contributing to public resentment towards the existing and highly visible income tax burden”.[63] For example, during the late 1970s, the scandalous “bottom of the harbour” schemes were being widely publicised.[64] Here, company profits were being stripped before they could be taxed and the records conveniently lost. The more widespread the knowledge that others were not paying their share, the more non-compliance increased. As a result, the income tax base was shrinking. These could be some of the reasons why tax morale was so low in Australia in 1981.

Taxation issues therefore became prominent during the 1984 election campaign, and to tackle tax reform as a package the then Prime Minister, Bob Hawke, announced that there would be a Summit of Taxation Reform in 1985 to try to review the problem. Based on the Summit proceedings, the Government announced a package of tax reforms in September 1985.[65] To list just a few, the reforms included introducing a Capital Gains Tax and a Fringe Benefits Tax, the company tax rate was raised to the top personal marginal tax rate, personal income tax rates were lowered, various industry concessions were abolished, the investment allowance was reduced slightly, gold profits became subject to taxation and extravagant concessions to superannuation were curtailed. These reforms were slowly introduced over a period of several years. Given that taxation reform was such a prominent issue to taxpayers during the mid to late 1980s, and the reforms “substantially improved the fairness of the tax system at the time”,[66] it is proposed here that these two factors may have led to the increase in tax morale among Australians from 1981 to 1995.

In the 1986/87 financial year, the ATO introduced a self-assessment system to taxation. As discussed by D’Ascenzo and Poulakis the move to a self-assessment system came about following an ATO review of the effectiveness of its traditional system of assessing income tax returns.[67] The ATO review concluded that the original assessment system was not cost effective and had little effect on taxpayer compliance.

Under the self-assessment system, taxpayers are required to lodge a tax return containing detailed information and calculations of their taxable income. This system differs from the original system in that returns are no longer subjected to technical scrutiny, and the ATO takes all deductions and claims made in a tax return at face value. All onus of responsibility is therefore placed on the taxpayer to prepare an accurate return. Audit activity is then primarily used post-assessment to check the accuracy of some returns. Under Pt IVA of the Income Tax Assessment Act 1936 (Cth), the ATO then has up to six years[68] in which to review the legitimacy of a claim and disallow it if they consider it to be illegitimate.[69]

Not only is the self-assessment system of taxation a more cost effective system for the ATO, but if one reviews the literature on regulatory theory, such a system is what regulatory scholars call a self-regulatory system. Regulatory scholars consistently argue that if those being regulated are allowed to self-regulate themselves in the first instance, then this serves to improve their voluntary compliance in the long-term.[70] This is because self-regulation is important for building and maintaining trust among regulators and regulatees. Several empirical studies have been able to show that trust can serve to nurture voluntary compliance.[71] Trust appears to be a resource like no other; it is not depleted though use but rather through lack of use.[72] Hence, the more that regulatory interactions are based on trust, the more likely regulators such as the ATO should be able to nurture the development of reciprocal trust relationships. Of course, for such a system to be sustainable long-term, it also requires that a backup strategy be in place to detect and penalise those who may attempt to cheat the system (hence, the purpose of post-assessment audits and penalties for illegitimate returns).

From the findings of this study, we can also see that trust was an important factor in predicting the level of tax morale among Australians. The implication here is that if Governments wish to improve taxpayers’ voluntary compliance with their taxation obligations then they will need to foster trust among those they regulate, which in turn should affect their tax morale. With the ATO’s move towards a more self-regulatory and trusting system of control in the mid to late 1980s, this strategy may have gone some way to increasing trust in the ATO and tax system, which in turn may have gone on to positively affect taxpayers’ level of tax morale.

A third possible explanation as to why tax morale may have increased in Australia between 1981 and 1995 can be found in the management literature.[73] The 1980s saw public administration being faced with growing State and public demands to become more market-focused, service oriented, open and efficient.[74] To respond to this, the ATO adopted a new organisational structure designed to make them more efficient and customer-focused. Instead of focusing so much on compliance management, risk control, or structuring the

application of enforcement discretion, the ATO slowly became more focused on service, customers, quality, transparency and process improvement.[75] In fact, the ATO was amongst the first tax administrations in the world to implement a new client-based organisational structure (the client based model is where staff are assigned to units that focus on specific groups of customers; for example, salary and wage earners, small business income taxpayers, and large business income taxpayers).[76] One of the advantages of such a client-based structure is that it allows tax administrations to better match their enforcement and educational programmes to the compliance patterns of different groups.[77] According to Verhorn and Brondolo, such a system has “the potential for delivering higher quality service to taxpayers and achieving high levels of compliance”.[78] If taxpayers feel that such an approach is likely to achieve better compliance levels among other taxpayers, then this may go on to influence their own tax morale. Such a client-focused approach is also likely to increase trust among taxpayers, as taxpayers are more likely to feel that their needs are being considered in the regulatory process.

Using data from two waves of the World Values Survey, the aim of this study was to investigate the level of tax morale among Australian citizens between 1981 and 1995. Much of the previous research on tax morale has been conducted in Europe and Latin America so it was of interest to see whether Australians were high or low on this concept. It was also of interest to see what shaped tax morale in Australia and whether tax morale had changed over the period of investigation. Furthermore, it was also of interest to see how tax morale changed over time in Australia in comparison to other OECD countries.

Like in previous international studies, a number of key variables were found to predict one’s level of tax morale in the present study. For example, trust in Parliament or the legal system was found to be an important predictor of tax morale. Those citizens who had higher levels of trust were also more likely to have higher levels of tax morale. Those whose sense of moral obligation was stronger (as measured through religiosity) were also found to be higher in tax morale. Analyses of the data also revealed a promising finding that tax morale had in fact increased in Australia between 1981 and 1995. Three plausible explanations for this increase were offered in the previous Section.

While we do not know whether the increase in tax morale over time has equated to substantially higher levels of tax compliance in 1995 compared to 1981, what we can say from the data is that policy decisions made by the Government over that time appear to have had a positive impact on Australian’s level of tax morale. However, in making this claim it should be noted that this study certainly has had its limitations. First of all, the data contained within the World Values Survey are somewhat general in focus and as a result, attitudes and issues to do specifically with taxation do not figure highly. A survey designed specifically to explore issues surrounding tax morale may therefore prove fruitful in the future. Second, the possible explanations offered in the previous Section for why tax morale may have increased in Australia between 1981 and 1995 have not been empirically tested. It could be the case that none of these suggestions would have held up under empirical testing or it could be the case that a number of alternative possibilities might explain the data better. The third limitation, or perhaps a suggestion for future research would be to measure attitudes to taxation both directly before and after a significant change to tax administration. By doing this, any change in attitude over time could be attributed specifically to that event (ie, unlike in the present study, there would be no question as to whether or not the event may have affected tax morale).

Even with these limitations, however, it should be noted that this study has provided the first ever statistical analysis of tax morale in Australia, how it differs from other countries around the world, and how it has changed between 1981 and 1995. As a result, it offers the reader an insight into how Australians’ attitudes towards taxation may have changed since 1981.

[*] Andrew Young School of Policy Studies, International Studies Program, 35 Broad St, Suite 605, Atlanta, GA 30303, USA; University of Basel, Wirtschaftswissenschaftliches Zentrum (WWZ), Basel (Switzerland) and CREMA Center for Research in Economics, Management and the Arts (Switzerland); e-mail: ecobtx@langate.gsu.edu, benno.torgler@unibas.ch.

[**] Centre for Tax System Integrity, Regulatory Institutions Network, Research School of Social Sciences, Australian National University; e-mail: tina.murphy@anu.edu.au.

[1] For example, J Alm, GH McClelland and WD Schulze, “Why Do People Pay Taxes?” (1992) 48 Journal of Public Economics 21.

[2] MG Allingham and A Sandmo, “Income Tax Evasion: A Theoretical Analysis” (1972) 1 Journal of Public Economics 323.

[3] For review, see B Torgler, “What Do We Know About Tax Morale and Tax Compliance?” (2001) 48 International Review of Economics and Business 395 (“Torgler, Tax Compliance”); B Torgler, “Is Tax Evasion Never Justifiable?” (2001) 19 Journal of Public Finance and Public Choice 143 (“Torgler, Tax Evasion”); and B Torgler, “Speaking to Theorists and Searching for Facts: Tax Morale and Tax Compliance in Experiments” (2002) 16 Journal of Economic Surveys 657 (“Torgler, Experiments”).

[4] S Dhami and A al-Nowaihi, “Why Do People Pay Taxes? An Explanation Based on Loss Aversion and Overweighting of Low Probabilities” in J Leitao (ed), NEP Report on Microeconomics (2004) http://lists.repec.org.

[5] V Braithwaite, “Dancing With Tax Authorities: Motivational Postures and Non-Compliant Actions” in V Braithwaite (ed), Taxing Democracy: Understanding Avoidance and Evasion (2003) 15.

[6] For the United States see, KW Smith and KA Kinsey, “Understanding Taxpayer Behavior: A Conceptual Framework With Implications For Research” (1987) 12 Law and Society Review 640; MJ Graetz and LL Wilde, “The Economics of Tax Compliance: Facts and Fantasy” (1985) 38 National Tax Journal 355; and Alm et al, above n 1. For Switzerland, see BS Frey and LP Feld, “Deterrence and Morale in Taxation: An Empirical Analysis” CESifo Working Paper No 760 (2002).

[7] Torgler, Experiments, above n 3.

[8] R Schwartz and S Orleans, “On Legal Sanctions” (1967) 34 University of Chicago Law Review 282; A Lewis, The Psychology of Taxation (1982); JA Roth, JT Scholz and AD Witte (eds), Taxpayer Compliance: Vol 1 and Vol 2 (1989); Alm et al, above n 1; J Alm, GH McClelland and WD Schulze, “Changing the Social Norm of Tax Compliance by Voting” (1999) 52 Kyklos 141; WW Pommerehne, A Hart and BS Frey, “Tax Morale, Tax Evasion and the Choice of Policy Instruments in Different Political Systems” (1994) 49 (Supplement) Public Finance 52; WW Pommerehne and H Weck-Hannemann, “Tax Rates, Tax Administration and Income Tax Evasion in Switzerland” (1996) 88 Public Choice 161; BS Frey, Not Just For the Money: An Economic Theory of Personal Motivation (1997); Frey and Feld, above n 6; and LP Feld and JR Tyran, “Tax Evasion and Voting: An Experimental Analysis” (2002) 55 Kyklos 197.

[9] BR Jackson and VC Milliron, “Tax Compliance Research: Findings, Problems, and Prospects” (1986) 5 Journal of Accounting Literature 125, 136.

[10] Y Song and T Yarbrough, “Tax Ethics and Taxpayer Attitudes: A Survey” [September 1978] Public Administration Review 442, 444.

[11] Feld and Tyran, above n 8, 199.

[12] LP Feld and BS Frey, “Trust Breeds Trust: How Taxpayers are Treated” (2002) 3 Economics of Governance 87, 88-9.

[13] For exceptions, see, B Torgler, “Tax Morale, Rule Governed Behaviour and Trust” (2003) 14 Constitutional Political Economy 119 (“Torgler, Trust”); B Torgler, “To Evade Taxes or Not: That is the Question” (2003) 32 Journal of Socio-Economics 283 (“Torgler, Questions”); and B Torgler, “Tax Morale in Latin America” Public Choice (forthcoming) (“Torgler, Latin America”).

[14] M Inglis, “Is Self Assessment Working? The Decline and Fall of the Australian Income Tax System” (Paper presented at the ATAX 5th International Conference on Tax Administration, Sydney, 4-5 April 2002).

[15] J Job and D Honaker, “Short-term Experience With Responsive Regulation in the Australian Taxation Office” in V Braithwaite (ed), Taxing Democracy: Understanding Avoidance and Evastion (2003) 111.

[16] G von Schanz, “Die Steuern der Schweiz in Ihrer Entwicklung Seit Beginn des 19” (1890) Jahrhunderts, Vol I to V; for an overview see LP Feld, “Tax Evasion in Switzerland: The Roles of Deterrence and Responsive Regulation” (Paper presented at the Tax Evasion, Trust, and State Capacities Conference, St. Gallen, 17-19 October 2003).

[17] G Schmölders, “Finanzpsychologie” (1952) 13 Finanzarchiv 1; G Schmölders, Das Irrationale in der Öffentlichen Finanzwissenschaft (1960) (Schmölders 1960”); G Schmölders, Volkswirtschaftslehre und Psychologie (1962); and G Schmölders, “Survey Research in Public Finance: A Behavioral Approach to Fiscal Theory” (1970) 25 Public Finance 300.

[18] Schmölders 1960, above n 17.

[19] B Strümpel, “The Contribution of Survey Research to Public Finance” in AT Peacock (ed), Quantitative Analysis in Public Finance (1969) 14.

[20] Lewis, above n 8; and J Vogel, “Taxation and Public Opinion in Sweden: An Interpretation of Recent Survey Data” (1974) 27 National Tax Journal 499.

[21] See, eg, Torgler, Tax Compliance, above n 3; Torgler, Trust, above n 13; Torgler, Questions, above n 13; and Torgler, Latin America, above n 13.

[22] Torgler, Latin America, above n 13.

[23] Torgler, Tax Compliance, above n 3.

[24] R Inglehart, World Values Surveys and European Values Surveys, 1981-1984, 1990-1993, and 1995-1997 (2003).

[25] The survey was not conducted in Australia during the 1990-91 or 1999-2001 round. It should be noted that the authors of this article did not collect the data for the Australian waves of the World Values Survey. Instead, researchers at Edith Cowan University in Western Australia were involved in collecting the Australian data for 1981 and 1995.

[26] See www.worldvaluessurvey.com.

[27] For a sample of a typical World Values Survey see ibid.

[28] We have not included “trust in the legal system” and “trust in the Parliament” in the same model because there is a strong correlation between the variables that makes it impossible to clearly separate the effects of the two variables if they were included in one model.

[29] Some may criticise the way in which tax morale is measured here, as only one question has been used to measure the concept. However, in order to be consistent with previously published research it was decided that this item would be appropriate and sufficient to measure tax morale among Australians. Furthermore, when discussing the concept of taxpayer ethics – a concept very similar to tax morale – Jackson and Milliron, above n 9, 137, suggested that specific and individual ethical measures are probably more fruitful than aggregated measures. They based this suggestion on the finding of Lewis who failed to find a general factor of tax ethics: A Lewis, “An Empirical Assessment of Tax Mentality” (1979) 34 Public Finance 245. See also G Richardson and AJ Sawyer, “A Taxonomy of the Tax Compliance Literature: Further Findings, Problems and Prospects” (2001) 16 Australian Tax Forum 137.

[30] This scale was reversed scored so that it was consistent with the scoring formats of other questions used in the study. For example, negative responses to a question will all be denoted with smaller numbers.

[31] Torgler, Tax Compliance, above n 3.

[32] Torgler, Latin America, above n 13.

[33] JT Scholz and M Lubell, “Trust and Taxpaying: Testing the Heuristic Approach to Collective Action” (1998) 42 American Journal of Political Science 398.

[34] K Murphy, “The Role of Trust in Nurturing Compliance: A Study of Accused Tax Avoiders” (2004) 28 Law and Human Behavior 187.

[35] Torgler, Tax Compliance, above n 3.

[36] BB Hull, “Religion Still Matters” (2000) 26 Journal of Economics 35; BB Hull and F Bold, “Towards an Economic Theory of the Church” (1989) 16 International Journal of Social Economics 5; and J Lipford, RE McCormick and RD Tollison, “Preaching Matters” (1993) 21 Journal of Economic Behavior and Organization 235

[37] This variable was taken and used as a continuous variable in the analyses.

[38] Jackson and Milliron, above n 9.

[39] J Andreoni, B Erard and J Feinstein, “Tax Compliance” (1998) 36 Journal of Economic Literature 818.

[40] Frey and Feld, above n 6.

[41] C Tittle, Sanctions and Social Deviance: The Question of Deterrence (1980); Jackson and Milliron, above n 9; Richardson and Sawyer, above n 29; and A Wearing and B Headey, “The Would-be Tax Evader: A Profile” (1997) 13 Australian Tax Forum 3.

[42] Tittle, above n 41.

[43] Ibid.

[44] PA Hite, “Identifying and Mitigating Taxpayer Non-compliance” (1997) 13 Australian Tax Forum 155.

[45] Tittle, above n 41.

[46] Lewis, above n 8.

[47] Hite, above n 44.

[48] Lewis, above n 8.

[49] Schmölders 1960, above n 17.

[50] For example, Torgler, Tax Compliance, above n 3; Torgler, Trust, above n 13; and Torgler, Latin America, above n 13.

[51] P Kennedy, A Guide to Econometrics (4th d, 1998).

[52] In all the estimations in this article we have not included “trust in the legal system” and “trust in the Parliament” in the same model. This is because there is a strong correlation between the variables that makes it impossible to clearly separate the effects of the two variables if they were included in one model. Nor have we included “income” or an “individual’s tax rate” in the same model for the same reasons.

[53] Sec also V Braithwaite and M Levi (eds), Trust and Governance (1998); and Murphy, above n 34.

[54] Hite, above n 44.

[55] Torgler, Tax Compliance, above n 3; and Torgler, Latin America, above n 13.

[56] This was done by taking the original weight variable, and multiplying it by a constant for each survey. If the data were not weighted it could have produced biases in the pooled analysis.

[57] Torgler, Tax Evasion, above n 3.

[58] G Hofstede, Culture’s Consequences: International Differences in Work-Related Values (1980); and G Hofstede, Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organizations Across Nations (2001).

[59] See Torgler, Tax Evasion, above n 3

[60] It should be noted, however, that the biggest average increase in tax morale in the OECD countries occurred between 1990 and 1995. As the 1990 wave of the World Values Survey was not conducted in Australia it is unclear whether tax morale in Australia increased more between 1990 and 1995 or whether there was a progressive increase from 1981. If just focusing on the difference between average tax morale scores in 1981 and in 1995, however, it can be seen that tax morale increased significantly more over this time in Australia than in the OECD countries that were tested in both 1981 and 1995.

[61] At least for those OECD countries that were tested in 1995.

[62] JP Smith, Taxing Popularity: The Story of Taxation in Australia (1993).

[63] lbid 111.

[64] M Levi, Of Rule and Revenue (1988).

[65] For a detailed discussion see Smith, above n 62.

[66] RL Mathews, “Some Reflections on the 1985 Tax Reforms” (1985) 2 Australian Tax Forum 415, 424.

[67] M D’Ascenzo and T Poulakis, “Self-assessment: Quo Vadis?” (2002) 36 Taxation in Australia 412.

[68] Longer in the case of blatant tax evasion.

[69] D’Ascenzo and Poulakis, above n 67.

[70] For example, I Ayres and J Braithwaite, Responsive Regulation: Transcending the Deregulation Debate (1992); and M Sparrow, The Regulatory Craft: Controlling Risks, Solving Problems and Managing Compliance (2000).

[71] Ayres and Braithwaite, above n 70; Murphy, above n 34; and J Braithwaite and T Makkai, “Trust and Compliance” (1994) 4 Policing and Society 1.

[72]D Gambetta (ed), Trust, Making and Breaking Cooperative Relations (1988).

[73]OE Hughes, Public Management and Administration (1994); and Sparrow, above n 70.

[74] Job and Honaker, above n 15; and Hughes, above n 73.

[75] Job and Honaker, above n 15.

[76] Prior to this, a function-based structure was used by the ATO (eg, a separate division for processing tax returns, another for auditing taxpayers, and another for collecting arears).

[77] CL Verhorn and J Brondolo, “Organizational Options For Tax Administration” (1999) 53 Bulletin for International Fiscal Documentation 499.

[78] Ibid 505.

AustLII:

Copyright Policy

|

Disclaimers

|

Privacy Policy

|

Feedback

URL: http://www.austlii.edu.au/au/journals/JlATax/2004/9.html