Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) There are these consequences (in most cases) if you can obtain a roll - over when your ownership of more than one * CGT asset (the original assets ) ends and you acquire one or more CGT assets (the new assets ) in a situation covered by this Division.

Example: You own 100 shares in a company. The company cancels these shares and issues you with 10 shares in return.

(1A) A * car, motor cycle or similar vehicle must not be one of the new assets.

(2) A * capital gain or a * capital loss you make from each original asset is disregarded.

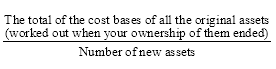

(3) If you * acquired all the original assets on or after 20 September 1985, the first element of each new asset's cost base is:

The first element of each new asset's * reduced cost base is worked out similarly.

Note 1: No other elements of the cost base of the new asset are affected by the roll - over.

Note 2: There are special indexation rules for roll - overs: see Division 114.

(4) If you * acquired all the original assets before 20 September 1985, you are taken to have acquired each new asset before that day.

Note: A capital gain or loss you make from a CGT asset you acquired before 20 September 1985 is generally disregarded: see Division 104. This exemption is removed in some situations: see Division 149.

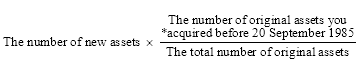

(5) If you * acquired some of the original assets before 20 September 1985, you are taken to have acquired a number of new assets before that day. It is the maximum possible that does not exceed:

If the result is less than one, none of the new assets are taken to have been * acquired before 20 September 1985.

Example: To continue the example, suppose you acquired 67 of the 100 original shares before 20 September 1985. The number of new shares that you are taken to have acquired before that day cannot exceed:

So, you are taken to have acquired 6 of the 10 shares before that day.

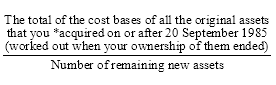

(6) These rules are relevant to each remaining new asset. The first element of each one's * cost base is:

The first element of each one's * reduced cost base is worked out similarly.

Note: There are special indexation rules for roll - overs: see Division 114.

Example: To continue the example, suppose the total of the cost bases of the 33 shares you acquired on or after 20 September 1985 is $400.

The first element of the cost base of each of the remaining 4 shares is:

The first element of the reduced cost base of those 4 shares is worked out similarly.

(7) However, subsections (4) and (5) are taken never to have applied to a * share to which subsection 104 - 195(6) applies (CGT event J4).