Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to dollar amounts mentioned in the following provisions:

(a) subsection 74(1);

(b) subsection 80(2);

(c) subsection 82(3);

(d) paragraph 138(1)(a);

(e) subsection 206(3);

(f) paragraph 216(1)(b);

(g) paragraph 219(1)(b);

(h) subsection 234(2);

(i) subsection 240(3);

(j) section 252;

(k) section 254;

(l) paragraphs 263(1)(a) and (b);

(m) paragraph 267(3)(a).

(2) The dollar amount mentioned in the provision, for an indexation year in which the indexation factor is greater than 1, is replaced by the amount worked out using the formula:

![]()

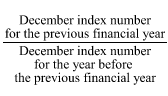

(3) The indexation factor for an indexation year is the number worked out using the following formula:

(4) The indexation factor is to be calculated to 3 decimal places, but increased by .001 if the fourth decimal place is more than 4.

(5) Calculations under subsection (3):

(a) are to be made using only the December index numbers published in terms of the most recently published index reference period for the Consumer Price Index; and

(b) are to be made disregarding December index numbers that are published in substitution for previously published December index numbers (except where the substituted numbers are published to take account of changes in the index reference period).

(5A) For the purposes of replacing the dollar amount mentioned in subsection 74(1) for an indexation year starting on or after 1 July 2013, the indexation factor is reduced by the brought - forward CPI indexation amount for the year, but not below 1.

(6) In this section:

"brought-forward CPI indexation amount" for an indexation year starting on or after 1 July 2013 means 0.007 less any reduction made under subsection (5A) for an earlier indexation year.

"December index number" means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of the 3 months ending on 31 December.