Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to an employee who:

(a) has been incapacitated for work as a result of an injury; and

(b) retired (whether voluntarily or otherwise) from his or her employment at any time after the commencement of this section; and

(c) as a result of the retirement, receives a lump sum benefit under a superannuation scheme; and

(d) rolled - over part of the lump sum benefit into a superannuation fund or an approved deposit fund.

(2) Compensation is payable to the employee for the injury under this section for each week after the date of the retirement during which the employee is incapacitated.

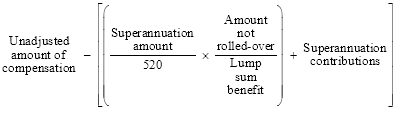

(3) The amount of compensation is an amount worked out using the formula:

where:

"Unadjusted amount of compensation" means the amount of compensation that would have been payable to the employee for a week if:

(a) section 31, other than subsection 31(8), had applied to the employee; and

(b) the week were a week referred to in subsection 31(4).

"Amount not rolled-over" means the amount not rolled - over or withdrawn from the superannuation fund or approved deposit fund to which the lump sum benefit was rolled - over.

"Lump sum benefit" means the amount of the lump sum benefit received by the employee.

"Superannuation amount" means the superannuation amount received by the employee as a lump sum.

(4) In this section:

"approved deposit fund" has the same meaning as in section 34.

"rolled-over" has the same meaning as in section 34.

"superannuation fund" has the same meaning as in section 34.