Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) In this Act, unless the contrary intention appears:

"compensation" has the meaning given by subsection (2).

Note: See also section 1163B.

"compensation affected payment" means:

(aa) an age pension; or

(a) a disability support pension; or

(b) a parenting payment; or

(c) a social security benefit; or

(f) a carer payment; or

(g) a special needs disability support pension; or

(h) a special needs disability support wife pension; or

(k) a former payment type; or

(l) any of the following:

(i) an advance pharmaceutical allowance;

(ii) a telephone allowance;

(iv) an education entry payment;

(v) a pensioner education supplement;

where, in order to be qualified for the allowance, payment or supplement, a person must be receiving, or receiving at a particular time, another kind of payment and that other kind of payment (the underlying compensation affected payment ) is a compensation affected payment to which any of paragraphs (aa) to (k) applies; or

(m) a fares allowance, where:

(i) if subparagraph 1061ZAAA(1)(b)(i), (ii) or (iii) applies--the allowance or payment (the underlying compensation affected payment ) mentioned in that subparagraph is a compensation affected payment to which any of paragraphs (aa) to (k) of this definition applies; or

(ii) if subparagraph 1061ZAAA(1)(b)(iv) applies--in order to be qualified for the supplement mentioned in that subparagraph, a person must be receiving another kind of payment and that other kind of payment (the underlying compensation affected payment ) is a compensation affected payment to which any of paragraphs (aa) to (k) of this definition applies.

"compensation part" , in relation to a lump sum compensation payment, has the meaning given by subsections (3) and (4).

"compensation payer" means:

(a) a person who is liable to make a compensation payment; or

(b) an authority of a State or Territory that has determined that it will make a payment by way of compensation to another person, whether or not the authority is liable to make the payment.

"event that gives rise to a person's entitlement to compensation" has the meaning given by subsection (5A).

"former payment type" means:

(a) an invalid pension under the 1947 Act; or

(b) an invalid pension under this Act as previously in force; or

(ba) a disability wage supplement under this Act as previously in force; or

(c) a sheltered employment allowance under the 1947 Act; or

(d) a sheltered employment allowance under this Act as previously in force; or

(e) an unemployment benefit under the 1947 Act; or

(f) a sickness benefit under the 1947 Act; or

(g) a special benefit under the 1947 Act; or

(h) a sickness benefit under this Act as previously in force; or

(ha) a job search allowance under this Act as previously in force; or

(i) a rehabilitation allowance under the 1947 Act payable in place of:

(i) an invalid pension under the 1947 Act; or

(ii) a sheltered employment allowance under the 1947 Act; or

(iii) an unemployment benefit under the 1947 Act; or

(iv) a sickness benefit under the 1947 Act; or

(v) a special benefit under the 1947 Act; or

(j) a rehabilitation allowance under this Act as previously in force payable in place of:

(i) a disability support pension; or

(ii) an invalid pension under this Act as previously in force; or

(iii) a sheltered employment allowance under this Act as previously in force; or

(iv) a social security benefit; or

(v) a sickness benefit under this Act as previously in force; or

(k) an invalid wife pension under the 1947 Act; or

(l) an invalid wife pension under this Act as previously in force; or

(m) a special needs invalid pension under this Act as previously in force; or

(n) a special needs invalid wife pension under this Act as previously in force; or

(o) a carer payment under this Act as previously in force; or

(p) a sole parent pension under this Act as previously in force; or

(q) a parenting allowance under this Act as previously in force; or

(r) a parenting payment under this Act as in force immediately before 1 July 2000; or

(s) a youth training allowance under Part 8 of the Student Assistance Act 1973 as previously in force; or

(t) a payment under this Act as previously in force declared by the Minister, by legislative instrument, to be a former payment type for the purposes of Part 3.14.

"income cut-out amount" , in relation to a person who has received a compensation payment, means the amount worked out using the formula in subsection (8), as in force at the time when the compensation was received.

"invalid wife pension" means:

(a) in relation to the 1947 Act, a wife's pension under the 1947 Act for a woman whose husband received an invalid pension under the 1947 Act; or

(b) in relation to this Act as previously in force, a wife pension for a woman whose partner received an invalid pension under this Act as previously in force.

"periodic payments period" means:

(a) the period to which a periodic compensation payment, or a series of periodic compensation payments, relates; or

(b) in the case of a payment of arrears of periodic compensation payments--the period to which those payments would have related if they had not been made by way of an arrears payment.

"potential compensation payer" means a person who, in the Secretary's opinion, may become a compensation payer.

"receives compensation" has the meaning given by subsection (5).

"special needs disability support wife pension" means a special needs wife pension for a woman whose partner receives a special needs disability support pension.

"special needs invalid wife pension" means a special needs wife pension for a woman whose partner received a special needs invalid pension under this Act as previously in force.

(2) Subject to subsection (2B), for the purposes of this Act, compensation means:

(a) a payment of damages; or

(b) a payment under a scheme of insurance or compensation under a Commonwealth, State or Territory law, including a payment under a contract entered into under such a scheme; or

(c) a payment (with or without admission of liability) in settlement of a claim for damages or a claim under such an insurance scheme; or

(d) any other compensation or damages payment;

(whether the payment is in the form of a lump sum or in the form of a series of periodic payments and whether it is made within or outside Australia) that is made wholly or partly in respect of lost earnings or lost capacity to earn resulting from personal injury.

(2A) Paragraph (2)(d) does not apply to a compensation payment if:

(a) the recipient has made contributions (for example, by way of insurance premiums) towards the payment; and

(b) either:

(i) the agreement under which the contributions are made does not provide for the amounts that would otherwise be payable under the agreement being reduced or not payable because the recipient is eligible for or receives payments under this Act that are compensation affected payments; or

(ii) the agreement does so provide but the compensation payment has been calculated without reference to the provision.

(2B) A payment under a law of the Commonwealth, a State or a Territory that provides for the payment of compensation for a criminal injury does not constitute compensation for the purposes of this Act.

(2C) The reference in subsection (2B) to a criminal injury is a reference to a personal injury suffered, or a disease or condition contracted, as a result of the commission of an offence.

Compensation part of a lump sum

(3) Subject to subsection (4), for the purposes of this Act, the compensation part of a lump sum compensation payment is:

(a) 50% of the payment if the following circumstances apply:

(i) the payment is made (either with or without admission of liability) in settlement of a claim that is, in whole or in part, related to a disease, injury or condition; and

(ii) the claim was settled, either by consent judgment being entered in respect of the settlement or otherwise; or

(ab) 50% of the payment if the following circumstances apply:

(i) the payment represents that part of a person's entitlement to periodic compensation payments that the person has chosen to receive in the form of a lump sum; and

(ii) the entitlement to periodic compensation payments arose from the settlement (either with or without admission of liability) of a claim that is, in whole or in part, related to a disease, injury or condition; and

(iii) the claim was settled, either by consent judgment being entered in respect of the settlement or otherwise; or

(b) if those circumstances do not apply--so much of the payment as is, in the Secretary's opinion, in respect of lost earnings or lost capacity to earn, or both.

(4) Where a person:

(a) has received periodic compensation payments; and

(b) after receiving those payments, receives a lump sum compensation payment (in this subsection called the LSP ); and

(c) because of receiving the LSP, becomes liable to repay an amount (in this subsection called the Repaid Periodic Compensation Payment -- RPCP ) equal to the periodic compensation payments received;

then, for the purposes of subsection (3), the amount of the lump sum compensation payment is:

![]()

(4A) For the purposes of this Act, a payment of arrears of periodic compensation payments is not a lump sum compensation payment.

Receives compensation

(5) A person receives compensation whether he or she receives it directly or whether another person receives it, on behalf of, or at the direction of the first person.

(5A) For the purposes of subsection (2B) of this section and Part 3.14, the event that gives rise to a person's entitlement to compensation for a disease, injury or condition is:

(a) if the disease, injury or condition was caused by an accident--the accident; or

(b) in any other case--the disease, injury or condition first becoming apparent;

and is not, for example, the decision or settlement under which the compensation is payable.

Insurer

(6) A reference in Part 3.14 to an insurer who is, under a contract of insurance, liable to indemnify a compensation payer or a potential compensation payer against a liability arising from a claim for compensation includes a reference to:

(a) an authority of a State or Territory that is liable to indemnify a compensation payer against such a liability, whether the authority is so liable under a contract, a law or otherwise; or

(b) an authority of a State or Territory that determines to make a payment to indemnify a compensation payer against such a liability, whether or not the authority is liable to do so.

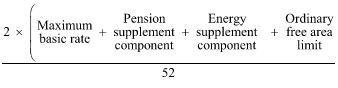

(8) For the purposes of the definition of income cut - out amount in subsection (1), the formula is as follows:

where:

"energy supplement component" means the energy supplement worked out under point 1064 - C3 for a person who is not a member of a couple:

(a) whether or not the person for whom the income cut - out amount is being worked out is a member of a couple; and

(b) whether or not that point applies to the person for whom the income cut - out amount is being worked out.

"maximum basic rate" means the amount specified in column 3 of item 1 of the table in point 1064 - B1.

"ordinary free area limit" means the amount specified in column 3 of item 1 of the table in point 1064 - E4.

"pension supplement component" means the pension supplement amount worked out under point 1064 - BA3 for a person who is not a member of a couple:

(a) whether or not the person for whom the income cut - out amount is being worked out is a member of a couple; and

(b) whether or not that point applies to the person for whom the income cut - out amount is being worked out.